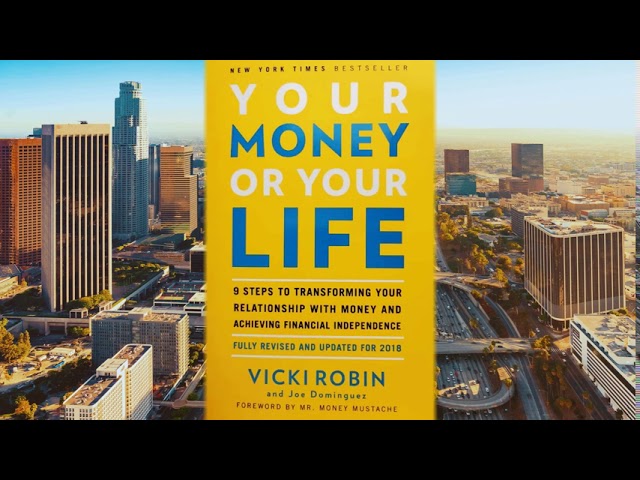

If you’re looking for a way to transform your relationship with money and achieve financial independence, then Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence is the book for you. Written by two well-known financial experts, Vicki Robin and Joe Dominguez, this book provides an in-depth look at how we can improve our finances and create long-term financial stability. It is a comprehensive guide that covers everything from budgeting to investing, as well as helpful tips on creating multiple streams of income. Through a combination of thoughtful advice and personal anecdotes, Your Money or Your Life teaches readers how to make smart decisions about their money and achieve true financial freedom.

Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence Review

Are you looking for a way to dramatically improve your relationship with money and achieve financial independence? Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence by Vicki Robin and Joe Dominguez is the perfect guide. This book offers a proven system to help you gain control of your finances, get out of debt, and secure a comfortable retirement.

Key Features:

1. Learn how to make better financial decisions

2. Find ways to increase your income

3. Identify hidden fees that are draining your wealth

4. Create a savings plan that works

5. Develop an investment strategy that fits your lifestyle

6. Make the most of Social Security and other retirement benefits

7. Understand the power of giving and how it can benefit your financial health

8. Find purposeful work that aligns with your values and goals

9. Use mindfulness techniques to stay on track

This comprehensive guide provides step-by-step instructions on how to evaluate your current situation, create a budget, pay off debts, understand investments, and use mindfulness techniques to stay motivated. With Your Money or Your Life, you’ll learn how to use money as a tool for achieving life goals such as travel, education, career advancement, owning a home and more. The authors provide actionable advice on topics including credit cards, mortgages, taxes and insurance – all designed to help you reach financial freedom faster than ever before!

Product Details

| Product Name | Genre | Author |

|---|---|---|

| Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence | Self-Help | Vicki Robin and Joe Dominguez |

| ISBN-13 | 9780143115766 | |

| A completely revised edition of one of the most influential books ever written on personal finance. | ||

| This book goes beyond the usual tactics of budgeting, saving money, and making wise investments. | ||

| It is about transforming your relationship with money and achieving the freedom to live life on your own terms. | ||

| The authors offer a nine-step program for creating financialindependence. | ||

| These steps include understanding your values, setting goals, eliminating debt, developing a balanced budget, cultivating saving, investing in appreciating assets, and giving back to the community. They also discuss how to create a successful retirement plan and provide advice on protecting yourself from financial predators. | ||

Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence Pros and Cons

Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence is a comprehensive guide to understanding your relationship with money, setting financial goals, and achieving financial independence. Written by Vicki Robin and Joe Dominguez, two financial experts, Your Money or Your Life provides readers with valuable insights into how to gain control of their finances and achieve their long-term financial goals.

Pros:

1. Comprehensive yet easy-to-understand guidance on personal finance: Your Money or Your Life is written in an accessible way that makes the complex world of personal finance manageable for any reader.

2. Detailed advice on budgeting, investing, and saving: The book offers practical advice on budgeting, investing, and saving that will help you make the most of your money.

3. Inspiring stories from people who have achieved financial independence: The authors provide inspiring stories from real people who have successfully achieved financial independence through following the steps outlined in the book.

Cons:

1. Not comprehensive enough for some readers: While the book offers great advice for those just starting out in their financial journey, more experienced readers may find it too basic.

2. Requires active engagement from readers: Following the steps outlined in Your Money or Your Life requires a lot of engagement from the reader; it’s not a passive approach to achieving financial success.

3. Outdated material: Though some of the advice in the book remains relevant today, other parts are outdated and no longer applicable in today’s economy.

Who are They for

Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence is a revolutionary guide that provides readers with the tools they need to break free from their financial worries and start taking control of their lives. Written by Vicki Robin and Joe Dominguez, this comprehensive book offers nine steps to help you understand your relationship with money, create a budget, save for retirement, and invest your hard-earned money wisely.

The authors’ holistic approach to financial planning helps people take back control of their finances, while still living life to the fullest. With inspiring stories and practical advice, they show how money can be used as a tool for creating meaningful wealth and achieving financial independence. Through their nine-step process, readers can make sound investments that will lead to consistent returns in the long run, allowing them to build true wealth that lasts for generations.

The authors also show how financial freedom can help reduce stress in life. They discuss how having fewer financial worries opens up more possibilities for creativity, growth, and peace of mind. By taking control of their finances, readers can finally have the freedom to pursue their passions without any distractions from debt or other financial obligations.

If you’re looking for a way to take charge of your finances and achieve financial independence, Your Money or Your Life is an invaluable resource. With its easy-to-follow steps and inspiring stories, this book can help you create a secure future for yourself and your loved ones.

My Experience for Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence

I used to be a financial mess. Living paycheck to paycheck, I was constantly struggling to make ends meet. Every month it felt like I was barely scraping by and I had no idea how to get out of this endless cycle. Then I found Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence.

This book changed my life. Through its nine steps I learned how to manage my money, invest wisely, and plan for the future. It taught me how to think about money in a whole new way so that I could achieve financial independence and stop living paycheck to paycheck.

The first step was understanding my current relationship with money and getting an honest picture of my financial situation. From there, I could figure out where I wanted to go and develop a plan for getting there. The next step focused on cutting down expenses so that I could save more money each month.

With the help of Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence, I was able to build up an emergency fund and start investing in stocks and mutual funds. This gave me security in case of an emergency and helped me grow my wealth over time.

After following the nine steps outlined in the book, I am now debt free, have an emergency fund, and can comfortably afford all of my monthly expenses. Thanks to this amazing book, I’m on track to achieving financial freedom!

What I don’t Like

Product Disadvantages:

1. The book is written from a US-centric perspective, which may not be applicable to other countries.

2. Some of the concepts discussed in the book may be outdated or irrelevant for readers who are already familiar with personal finance topics.

3. It can be difficult to follow some of the more complex financial principles discussed in the book without prior knowledge of the topic.

4. The cost of implementing all of the steps outlined in the book may not be feasible for all readers.

5. The book does not provide any online resources or supplemental material to support its advice and ideas.

How to Achieve Financial Independence with Your Money or Your Life

Are you looking for a way to transform your relationship with money and achieve financial independence? If so, Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence can help. This book is full of advice on how to reach your financial goals. Here are some tips from this best-selling guide:

- Track All Expenses. It’s important to be aware of where your money is going. Track all expenses, whether it’s a purchase at the grocery store or a payment for internet service. This will help you identify areas where you can save.

- Create a Budget. Create a budget that allows you to prioritize spending and saving. This will help you stay on track and ensure that you’re making progress towards your financial goals.

- Start Investing. Investing is an important part of achieving financial independence. Start small by investing in index funds and ETFs, then slowly increase the amount of money you put into investments as your income increases.

- Pay Off Debt. Pay off debt quickly so that you don’t have any lingering payments taking away from your savings. The quicker you pay off debt, the more money you’ll have available for other investments.

- Save for Retirement. Retirement should always be a priority. Set up automatic transfers from your checking account into a retirement fund each month, even if it’s only $50 or $100.

- Give Back. Finally, consider donating some of your money to worthy causes. Not only will it make you feel good, but it also has tax benefits.

Following these steps from Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence, you can take control of your finances and work towards financial freedom.

Questions about Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence

What is Your Money or Your Life?

Your Money or Your Life is a groundbreaking book that provides nine steps to transforming your relationship with money and achieving financial independence. Written by Vicki Robin, Joe Dominguez, and Monique Tilford, it helps you create a plan for managing your finances in order to reach a secure, fulfilling lifestyle.

How Can I Use Your Money or Your Life?

Your Money or Your Life can be used as a comprehensive guide to help you take control of your finances and make better decisions about how to spend and save your money. It will help you build a solid financial foundation, become debt-free, and develop an investment strategy that will allow you to achieve financial independence.

What Are the Benefits of Using Your Money or Your Life?

Using Your Money or Your Life can help you gain greater clarity on what’s truly important in life so that money doesn’t become an obstacle to achieving it. It also teaches you how to balance short-term goals with long-term ones while developing healthy habits around money. Additionally, You Money or Your Life provides guidance on building wealth and investing wisely so that you can eventually reach financial independence.

Hi, my name is Lloyd and I'm a book enthusiast. I love to read all kinds of books, from classic literature to modern fantasy, as well as non-fiction works. I also enjoy writing reviews and giving my opinion on the books that I have read.