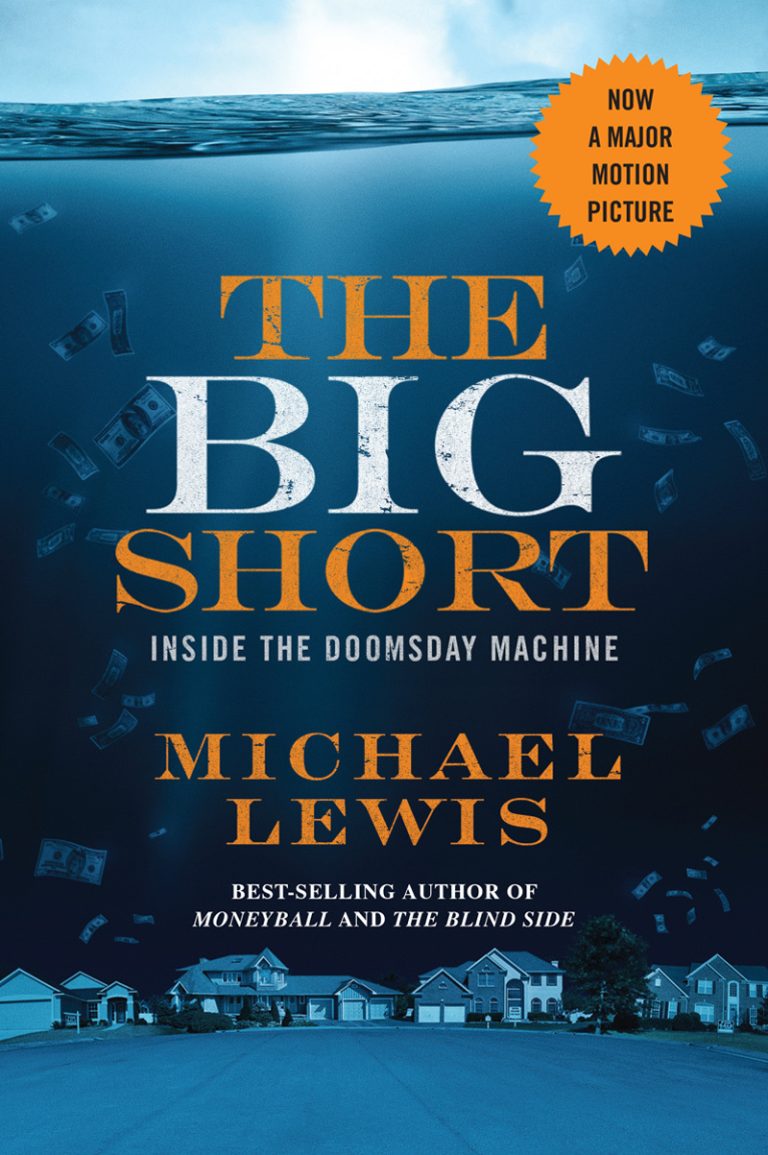

“The Big Short: Inside the Doomsday Machine” is a must-read for anyone interested in understanding the financial crisis of 2008. Written by Michael Lewis, this book provides an in-depth look into Wall Street and the people who caused the great recession. Through vivid storytelling, Lewis paints a compelling picture of the greed, corruption and recklessness that led to one of the biggest economic disasters in recent history. With its gripping narrative and analysis of complex topics, “The Big Short” makes for an interesting, enlightening read.

It offers an insider’s perspective on the events leading up to the economic meltdown, as well as a comprehensive overview of the players and institutions involved. Lewis examines how key decisions were made and how those decisions played out in the markets. He also explains some of the underlying mechanics of Wall Street such as derivatives, mortgage-backed securities and credit default swaps. Additionally, he delves into the ethical implications of these financial instruments and how they contributed to the crisis.

Overall, “The Big Short” is an essential resource for anyone wanting to gain insight into what went wrong during the global financial crisis. It provides a clear-eyed view of how complex financial instruments were used to create vast profits for some while leaving others vulnerable to economic collapse. The book is packed with valuable lessons that can help us avoid similar mistakes in the future.

The Big Short: Inside the Doomsday Machine Review

The Big Short: Inside the Doomsday Machine, written by Michael Lewis, is an essential read for anyone looking to understand the 2008 financial crisis. In this book, Michael Lewis dives deep into the story of a handful of investors who foresaw the collapse and placed bets against the banking system. Through his trademark wit, Lewis not only illuminates the dark underbelly of Wall Street but also explains how these investors made their money while everyone else was losing theirs.

Key Features:

1. Uncovers the true story behind the 2008 financial crisis

2. Explains how a few savvy investors made huge profits while others were left in ruin

3. Sheds light on how Wall Street’s greed led to one of the biggest economic disasters in history

4. Written with Michael Lewis’ trademark wit and insight

If you’re looking to understand what really happened during the 2008 financial crisis and why, then The Big Short: Inside the Doomsday Machine is a must-read. With its keen insights into the inner workings of Wall Street, this book serves as a cautionary tale about unchecked greed and its consequences. It also reveals how a select few investors saw past the hype and profited from it all. So, if you want to understand this pivotal moment in history, pick up The Big Short and let Michael Lewis guide you through it!

Product Details

| Product Details | Information |

|---|---|

| Title | The Big Short: Inside the Doomsday Machine |

| Author | Michael Lewis |

| Publisher | W. W. Norton & Company |

| Publication Date | March 3, 2010 |

| Page Number | 272 pages |

| ISBN-10 | 0393338827 |

| ISBN-13 | 978-0393338829 |

The Big Short: Inside the Doomsday Machine Pros and Cons

The Big Short: Inside the Doomsday Machine, is a critically acclaimed book written by Michael Lewis. It’s an eye-opening look into the world of finance, and how a few people were able to predict and profit from the 2008 financial crisis.

Pros:

1. The story is told in an easy-to-understand manner, which makes it perfect for readers who aren’t familiar with finance or economics.

2. It gives a fascinating insight into how Wall Street works and how some people made huge profits while others lost everything.

3. The characters are well-developed and engaging, making this a compelling read.

4. It’s full of suspense, as you follow along to see if the heroes can make their predictions come true before it’s too late.

Cons:

1. It does get quite dry at times, so it may be difficult to stay engaged throughout the entire book.

2. Readers who already have a good understanding of finance may find some parts of the book too basic.

3. There is a lot of technical jargon that could be hard to understand for some readers.

4. The events described are almost a decade old now, so some readers might not find them as relevant today.

Overall, The Big Short: Inside the Doomsday Machine is an excellent book for anyone who wants to learn more about Wall Street and the 2008 financial crisis. Whether you’re a finance expert or just starting out, there’s something here for everyone!

Who are They for

The Big Short: Inside the Doomsday Machine is a gripping, behind-the-scenes account of the financial crisis of 2008. Written by Michael Lewis, the bestselling author of Moneyball and The Blind Side, this book takes readers inside the lives and minds of the people who saw what was coming—and made billions betting against the American economy.

This first-hand look at Wall Street’s inner workings reveals how a handful of renegade investors anticipated the collapse of the housing market—and profited from it. Through interviews with key players in both sides of the market, Lewis follows their stories as they attempt to outwit powerful banks and hedge funds that are blindly throwing money at bad investments. In addition to providing insight into the financial industry, The Big Short: Inside the Doomsday Machine offers an unflinching portrait of America’s economic system and its consequences for everyday citizens.

Michael Lewis’s trademark wit and storytelling make The Big Short a riveting read that provides an unprecedented look into one of the most significant events in recent history. Whether you’re a finance enthusiast or just someone looking to gain a better understanding of our current economic climate, this book provides an illuminating view on how we ended up here.

My Experience for The Big Short: Inside the Doomsday Machine

I’m not a finance guru, but I can tell you one thing for sure: The Big Short: Inside the Doomsday Machine is the best book I’ve read on the 2008 financial crisis.

When I picked up this book, I was expecting a dry, technical tome on the intricacies of economic theory and high finance. Instead, what I got was an exciting and eye-opening journey through the world of CDOs, CDSs and other exotic financial instruments that were at the center of the biggest economic meltdown in history.

What makes this book so special? Well, for starters, it’s written in an easy-to-understand style that even someone like me, who knows little about finance, can understand. It’s full of fascinating stories about people who made big money betting against the housing market — something that seemed inconceivable at first.

But more importantly, The Big Short provides an invaluable glimpse into just how broken and corrupt our financial system truly is. It offers an insider’s perspective on all the shady dealings that went down during the crisis — from government bailouts to corporate greed — and shows us how we can prevent such catastrophes from happening again in the future.

If you’re looking for a gripping read with important lessons about our economy, then The Big Short: Inside the Doomsday Machine is definitely worth checking out.

What I don’t Like

Product Disadvantages List

1. Limited scope: The book only covers the events leading up to the 2008 financial crisis and does not provide insights into the current state of the economy.

2. Difficult to understand: Some of the concepts discussed in the book can be difficult for readers who are not familiar with finance.

3. Lack of solutions: The book does not offer any practical solutions or strategies for avoiding a similar economic collapse in the future.

4. Outdated information: Since it was published in 2010, some of the facts and figures in the book may no longer be accurate.

5. No new perspectives: Many of the arguments presented in the book have already been discussed extensively elsewhere.

How to Make Money by Investing in the Stock Market with The Big Short: Inside the Doomsday Machine

For those looking to make money in the stock market, The Big Short: Inside the Doomsday Machine by Michael Lewis is a must-read. This book dives deep into the 2008 financial crisis and provides an insider’s understanding of how Wall Street works. It also offers readers valuable insights into how to identify potential investments that have the potential to outperform the market. By reading this book, you can gain a better understanding of what makes certain stocks and bonds more attractive than others, as well as how to spot warning signs of impending economic trouble.

Using The Big Short as a guide, investors can learn how to analyze the underlying assets in order to determine their value and make informed decisions about when to buy and sell. Additionally, investors can learn how to build a diversified portfolio that takes into account various factors such as risk tolerance and desired return on investment. Furthermore, readers will gain valuable insight into how to protect themselves from being taken advantage of by large financial institutions, giving them an edge over other investors in volatile markets.

Ultimately, The Big Short: Inside the Doomsday Machine provides invaluable information for anyone interested in making money in the stock market. With its clear explanations of concepts such as derivatives and mortgage-backed securities, this book offers readers a comprehensive view of the financial landscape. So if you’re looking for an informative and entertaining read on how to become a successful investor, look no further than The Big Short.

Questions about The Big Short: Inside the Doomsday Machine

### What is The Big Short: Inside the Doomsday Machine?

The Big Short: Inside the Doomsday Machine is a New York Times best-selling book by Michael Lewis, which tells the story of the build-up of the housing and credit bubble during the 2000s that led to the financial crisis of 2007–2008. It profiles several people who predicted or profited from the subprime mortgage crisis, including hedge fund manager Michael Burry and banker Jared Vennett.

### How does The Big Short help readers understand the financial crisis?

The Big Short provides readers with an in-depth look at how the financial crisis was created, allowing them to gain insight into why it happened and what could have been done to prevent it. By following characters such as Burry and Vennett through their experiences, readers can develop a better understanding of the complex events that caused the market crash and its subsequent ripple effects. Additionally, The Big Short explains how Wall Street bankers were able to profit from these events while ordinary citizens suffered.

### Who should read The Big Short?

The Big Short is an excellent resource for anyone wanting to gain a better understanding of what caused the financial crisis of 2007–2008. It is particularly useful for students interested in finance, economics, business, and history, as well as those seeking to learn more about investing or financial regulation. Additionally, The Big Short is an interesting read for those who are curious about how large banks operate and how their actions can affect global markets.

Hi, my name is Lloyd and I'm a book enthusiast. I love to read all kinds of books, from classic literature to modern fantasy, as well as non-fiction works. I also enjoy writing reviews and giving my opinion on the books that I have read.