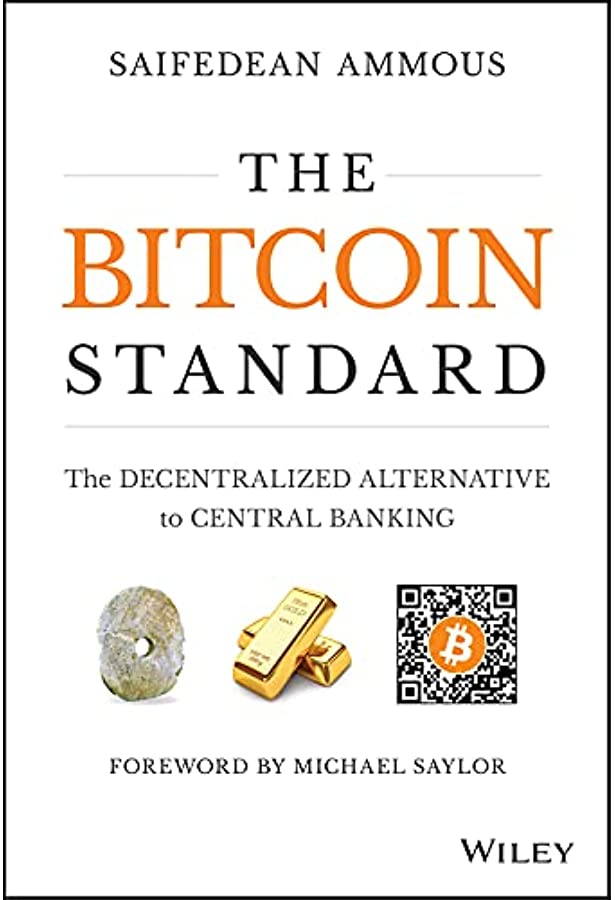

The Bitcoin Standard: The Decentralized Alternative to Central Banking is a book written by economist and researcher Saifedean Ammous. It is an in-depth exploration of the history, economics, and future potential of Bitcoin. In this book, Ammous explains why Bitcoin is the world’s first decentralized form of money and how its unique properties make it superior to other forms of money. He also provides an overview of the current monetary system and how it has been manipulated for centuries by governments and central banks. The Bitcoin Standard provides readers with a comprehensive look at the cryptocurrency revolution and its implications for our economic future.

This book has become a must-read for anyone interested in cryptocurrency and blockchain technology, as it provides readers with an understanding of the underlying principles that drive these technologies. It offers a detailed analysis of why Bitcoin is a better store-of-value than fiat currencies and examines the potential impacts that widespread adoption could have on our global economy. In addition, Ammous explores the long-term implications of Bitcoin’s fixed supply and how it can help protect against inflationary pressures caused by unchecked government spending. He also discusses the importance of decentralization for maintaining economic freedom in an increasingly digital world.

The Bitcoin Standard: The Decentralized Alternative to Central Banking Review

The Bitcoin Standard: The Decentralized Alternative to Central Banking

Bitcoin has become an increasingly popular form of currency and is quickly becoming an accepted alternative to traditional government-backed currencies. The Bitcoin Standard: The Decentralized Alternative to Central Banking explains the history of Bitcoin, its implications for the global economy, and how it can be used as a store of value and medium of exchange. Written by Saifedean Ammous, this book provides an in-depth look into the world of cryptocurrency and the decentralized financial system that it is creating.

Key features list:

1. Examines the history of money and why Bitcoin has potential to become an accepted form of currency.

2. Explains how Bitcoin works and its implications for monetary policy.

3. Analyzes the economic, political, and social implications of a decentralized financial system.

4. Provides insights on investing in digital currencies and using them for payments.

For those looking to understand the revolutionary world of cryptocurrencies, The Bitcoin Standard: The Decentralized Alternative to Central Banking is a must-read! Written by Saifedean Ammous, this book provides an in-depth examination of how Bitcoin has changed – and will continue to change – our current economy. This comprehensive guide offers readers not only an understanding of Bitcoin’s technology but also its economic and political implications on our global economy. Through his analysis, Ammous shows how digital currencies can act as a store of value, medium of exchange, and unit of account in the global marketplace. He also provides insights into investing in digital currencies and using them for payments. As cryptocurrency continues to gain traction in mainstream society, The Bitcoin Standard seeks to provide readers with a comprehensive understanding of this new technology.

Product Details

The Bitcoin Standard: The Decentralized Alternative to Central Banking Pros and Cons

The Bitcoin Standard: The Decentralized Alternative to Central Banking is an enlightening work that looks into the history and development of Bitcoin, its economic implications, and the effects it has had on the world. It provides a comprehensive overview of the cryptocurrency’s past, present, and future. Pros:

- Increased Transparency: Unlike traditional banking systems, transactions made in Bitcoin are available for everyone to view and verify. This helps protect against fraud since all transactions can be tracked.

- Decentralized System: There is no central authority controlling or governing Bitcoin, so users have complete autonomy over their funds.

- Low Transaction Fees: Since there are no intermediaries involved in Bitcoin transactions, fees tend to be much lower than those associated with traditional banking.

On the other hand, there are some drawbacks worth considering as well. Cons:

- High Volatility: The value of Bitcoin can fluctuate significantly from day to day, making it difficult to use as a reliable store of value.

- Regulatory Uncertainty: Governments around the world have yet to decide how they will regulate Bitcoin, creating a degree of legal uncertainty for users.

- Limited Acceptance: While more businesses are beginning to accept Bitcoin as payment, it is still far from being universally accepted.

In conclusion, The Bitcoin Standard: The Decentralized Alternative to Central Banking . is an interesting book that dives deep into the world of cryptocurrency and explores its potential implications. Despite some drawbacks, it offers many benefits such as increased transparency and low transaction costs. For anyone interested in understanding more about this cutting-edge technology, this book is a must-read!

Who are They for

The Bitcoin Standard: The Decentralized Alternative to Central Banking is a must-read for anyone interested in the future of money. Written by Saifedean Ammous, an economist and professor at the Lebanese American University, it dives deep into the history, technology and economics of Bitcoin and its role in disrupting the traditional banking system. It covers topics ranging from the impact of Bitcoin on central banks to its implications for global economic development. Ammous makes a compelling case for why Bitcoin is poised to become the world’s dominant currency and outlines the advantages of having a decentralized monetary system. With this book, readers will gain a better understanding of why Bitcoin is so revolutionary and what it could mean for the future of finance. The Bitcoin Standard provides an insightful look into the fascinating world of digital currencies, making it a must-read for finance enthusiasts and cryptocurrency investors alike.

My Experience for The Bitcoin Standard: The Decentralized Alternative to Central Banking

I had been living life as usual until I stumbled upon The Bitcoin Standard: The Decentralized Alternative to Central Banking. Before, I had no idea that something like cryptocurrency even existed. But after reading the book, my eyes were opened to a whole new way of living.

It was really eye-opening to learn about how the decentralized nature of Bitcoin means there is no need for any central authority or government control. Suddenly, money and wealth could be controlled by anyone with access to the internet!

It also made me realize that banks weren’t as powerful as they seemed and that there was an alternative out there. This book explains everything in such a comprehensive way that you don’t need to worry about understanding all the technical jargon.

The Bitcoin Standard has allowed me to take control of my finances and truly understand what it means to be free from government intervention. I’m so glad I came across this book and now I can help spread the word about cryptocurrencies.

What I don’t Like

- Product Disadvantages of The Bitcoin Standard: The Decentralized Alternative to Central Banking:

- 1. Limited use as a currency due to its volatile nature.

- 2. Complex technical requirements for users to understand and operate the system.

- 3. High transaction costs associated with mining and verifying transactions.

- 4. Risk of double-spending or fraud due to lack of central authority.

- 5. Difficulty in tracing and recovering lost coins due to the decentralized nature of the system.

How to Make Payments with The Bitcoin Standard: The Decentralized Alternative to Central Banking

Making payments with The Bitcoin Standard: The Decentralized Alternative to Central Banking is easy and fast. This revolutionary tool allows you to make payments without the need for a centralized bank, making it an ideal choice for those who want to stay away from traditional banking services. Here’s how you can get started using this innovative payment system.

First, you’ll need to sign up with a trusted cryptocurrency exchange or wallet provider. You’ll then need to purchase some Bitcoin (BTC) using your fiat currency of choice. Once you have your BTC, you can transfer it to your wallet and start making payments with it.

When you’re ready to make a payment, all you have to do is enter the recipient’s address into your wallet and enter the amount of BTC that you’d like to send. Some wallets allow you to set a fee so that your transaction will be processed faster. After confirming the details of the transaction, it will be sent out and should show up in the recipient’s wallet within minutes.

One of the advantages of using The Bitcoin Standard: The Decentralized Alternative to Central Banking is that your payments are secure and private. Since there is no central authority controlling the network, there is no way for anyone to track or monitor your transactions. Additionally, since there is no third party involved, you don’t have to worry about charges or fees associated with traditional banking services.

Using The Bitcoin Standard: The Decentralized Alternative to Central Banking, you can easily and quickly make payments without having to worry about security or privacy concerns. With this revolutionary tool at your disposal, you can enjoy a safe and convenient way of making payments online!

Questions about The Bitcoin Standard: The Decentralized Alternative to Central Banking

What is The Bitcoin Standard?

The Bitcoin Standard is a book about the economic implications of Bitcoin, a decentralized digital currency. It explores how Bitcoin could be used as an alternative to central banking and the traditional financial system.

What Are the Benefits of Using Bitcoin?

Using Bitcoin offers many benefits, such as increased financial privacy, lower transaction costs, faster payments, and more secure storage of funds. By using Bitcoin instead of traditional banking systems, users can make secure transactions without relying on third parties or government regulations.

How Does Bitcoin Work?

Bitcoin works by using a network of computers to process and verify transactions instead of relying on a centralized authority like a bank or government. All transactions are recorded on a public ledger called the blockchain which is secure and immutable. To prevent fraud, all transactions must be verified by the network before they can be added to the blockchain.

Hi, my name is Lloyd and I'm a book enthusiast. I love to read all kinds of books, from classic literature to modern fantasy, as well as non-fiction works. I also enjoy writing reviews and giving my opinion on the books that I have read.