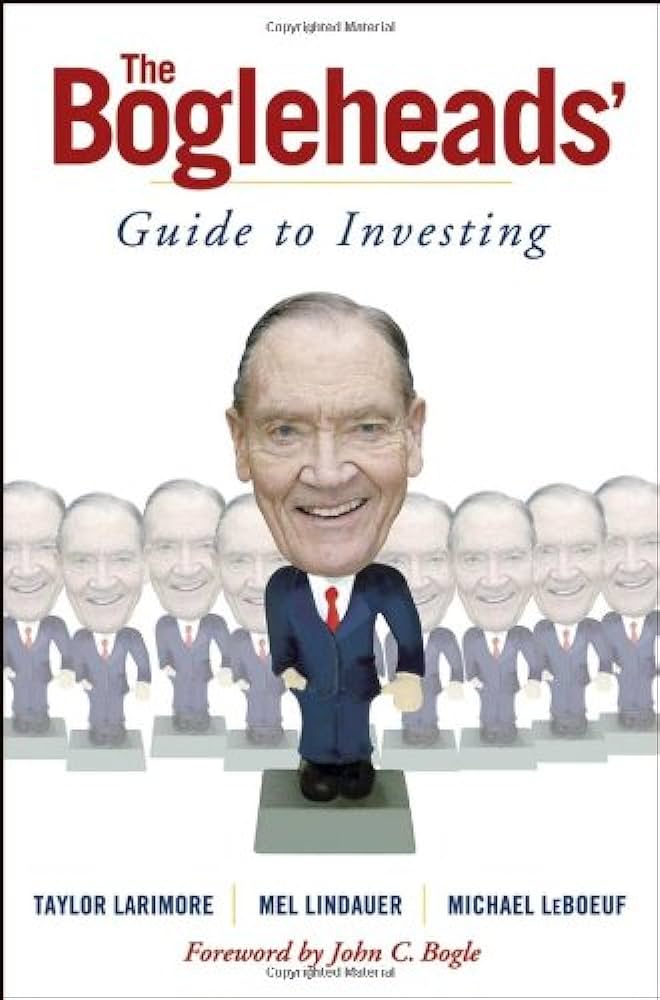

The Bogleheads’ Guide to Investing is an essential resource for anyone looking to become a savvy investor. Written by three of the most renowned experts in their fields, Taylor Larimore, Mel Lindauer, and Michael LeBoeuf, this book offers financial guidance that is both comprehensive and easy to understand. With step-by-step instructions on investing basics like asset allocation, portfolio diversification, and tax optimization, it’s perfect for beginners as well as experienced investors. The authors also provide advice on how to select mutual funds and ETFs (Exchange Traded Funds), as well as how to create a sustainable retirement plan or estate plan. Whether you’re just starting out with investing or looking to hone your skills, this book is an invaluable tool for achieving financial success.

The Bogleheads’ Guide to Investing Review

A Comprehensive Guide to Investing with The Bogleheads’ Way

It’s time to invest smarter. With the Bogleheads’ Guide to Investing, you can become an expert investor and make the most of your hard-earned money. Written by three of the foremost authorities on investing, this book provides a comprehensive guide to investing in an easy-to-understand style.

Key Features:

- Investment principles: Learn the investment principles that have been proven time and time again, such as diversification and cost control.

- Asset allocation: Develop an asset allocation strategy tailored to your individual needs and goals.

- Investment vehicles: Explore different types of investments and understand how each one works.

- Behavioral finance: Manage your emotions when it comes to investing, so you can stay focused on your long-term goals.

- Tax efficiency: Minimize taxes and maximize returns with strategies for reducing taxes on investments.

The Bogleheads’ Guide to Investing, written by Taylor Larimore, Mel Lindauer, and Michael LeBoeuf, is a must-have resource for anyone interested in taking control of their financial future. It covers all the basics – from selecting investments and creating a portfolio to minimizing taxes and understanding behavioral finance. With clear explanations, helpful examples, and simple strategies, this book will help you become a savvy investor and reach your financial goals. Get ready to invest like a pro!

Product Details

| Product Name | The Bogleheads’ Guide to Investing |

|---|---|

| Author | Taylor Larimore, Mel Lindauer, and Michael LeBoeuf |

| Publisher | John Wiley & Sons |

| Publication Date | October 2012 |

| Format | Paperback |

| Edition Number | 2nd Edition |

| Number of Pages | 336 Pages |

| ISBN-10 Number | 1118921283 |

| ISBN-13 Number | 978-1118921285 |

The Bogleheads’ Guide to Investing Pros and Cons

1. Pros:

The Bogleheads’ Guide to Investing provides an easy-to-follow, comprehensive introduction to investing that is suitable for new and experienced investors alike. Written by three of the world’s most highly respected investment experts, Taylor Larimore, Mel Lindauer and Michael LeBoeuf, it takes readers step-by-step through the process of constructing a portfolio that will meet their goals for long-term growth and security. With practical tips on asset allocation, diversification and index investing, as well as advice on retirement planning and tax considerations, this book is an invaluable resource for anyone looking to make smart investments.

2. Cons:

One potential downside of The Bogleheads’ Guide to Investing is its lack of focus on individual stocks. While it covers the basics of stock selection and analysis, it does not provide in-depth guidance on how to select specific stocks or assess their performance over time. Additionally, there are no specific strategies or recommendations for trading or day trading stocks. For those who prefer a more active approach to investing, this book may not be the best option.

Who are They for

The Bogleheads’ Guide to Investing is a comprehensive guide to help you make the most of your financial future. Written by four of the most respected and successful investors in the world – Taylor Larimore, Mel Lindauer, Michael LeBoeuf and John C. Bogle – this guide will show you how to manage your assets and create a portfolio that works for you. With practical advice and helpful strategies, The Bogleheads’ Guide to Investing covers everything from asset allocation to retirement planning, tax management, and more. Whether you are just beginning your investing journey or have been managing investments for years, this book will give you the confidence to make sound decisions with your money.

This book is packed with valuable information that can help you reach your financial goals. It offers simple explanations on a variety of topics such as asset classes, diversification, mutual funds, ETFs, stocks, bonds, taxes, and much more. You’ll also find detailed guidance on creating an investment plan that suits your needs and risk tolerance level. Plus, The Bogleheads’ Guide to Investing features case studies that provide real-world examples for better understanding complex concepts. And with its easy-to-follow style and straightforward language, readers of all levels can benefit from this comprehensive guide.

Ultimately, The Bogleheads’ Guide to Investing is the perfect resource for anyone looking to take control of their finances. It provides clear direction on how to build wealth safely and responsibly over time. With this book as your guide, you’ll be well on your way to achieving long-term financial success!

My Experience for The Bogleheads’ Guide to Investing

I used to be a novice investor, lost and confused when it came to making the right choices for my financial future. I was overwhelmed with all of the information out there and didn’t know where to start. That is until I stumbled across The Bogleheads’ Guide to Investing by Taylor Larimore.

This book changed everything for me! It’s like someone took all of the best advice from some of the most successful investors in the world, distilled it into an easy-to-read guide, and put it in my hands.

The Bogleheads’ Guide to Investing demystified investing for me. It broke down complex concepts like asset allocation and portfolio diversification into simple, straightforward explanations that even a beginner could understand. It also included practical advice on topics like how to choose mutual funds and ETFs, how to build a retirement portfolio, and how to handle taxes. All of this was invaluable knowledge that finally enabled me to take control of my investments!

What I found especially helpful were the real-world examples given throughout the book – they showed me what other successful investors were doing so I could learn from their strategies as well. Plus, there are tons of resources listed at the end of each chapter if you want to dive deeper into any particular topic.

Overall, The Bogleheads’ Guide to Investing helped me become a smarter, more informed investor. If you’re looking for a comprehensive yet practical guide on investing, then this is definitely worth your time!

What I don’t Like

Product Disadvantages:

1. The book is limited in its scope, focusing primarily on index mutual funds and ETFs.

2. It does not provide detailed investment advice.

3. It doesn’t include more advanced topics such as tax optimization or estate planning.

4. The authors have a bias towards passive investing, which may not be suitable for all investors.

5. Some of the information is outdated due to frequent changes in the markets and regulations.

How to Invest Wisely and Easily with The Bogleheads’ Guide to Investing

Are you looking for an easy and reliable way to invest your money? With The Bogleheads’ Guide to Investing, you can learn the proven strategies of successful investors in order to make informed decisions about your portfolio. Written by experienced financial professionals Taylor Larimore, Mel Lindauer and Michael LeBoeuf, this comprehensive guide will help you understand the fundamentals of investing and how to make smart choices to reach your financial goals.

The book covers topics such as diversification, asset allocation, index funds, retirement planning and taxes, all in an easy-to-understand format. You’ll learn how to develop a sound investment strategy that fits your individual needs, as well as tactics for avoiding common mistakes. With its practical advice and real-life examples, this book is perfect for both beginner and seasoned investors who are looking for actionable guidance on growing their wealth.

The Bogleheads’ Guide to Investing also provides detailed information on different types of investments such as stocks, bonds, mutual funds and exchange traded funds (ETFs). Additionally, it includes helpful resources such as glossaries of investment terms and links to additional online resources. Whether you are just getting started or have been investing for years, this comprehensive guide will help you navigate the complex world of investing with confidence.

So don’t wait any longer – start building your financial future today with The Bogleheads’ Guide to Investing!

Questions about The Bogleheads’ Guide to Investing

###What is The Bogleheads’ Guide to Investing?

The Bogleheads’ Guide to Investing is a comprehensive guide to investing and personal finance, authored by Taylor Larimore, Mel Lindauer and Michael LeBoeuf. It provides practical advice on how to create and maintain an investment portfolio that will provide you with long-term financial security. The book covers a wide variety of topics, including asset allocation, index funds, tax planning, retirement planning, estate planning and more.

###What topics does The Bogleheads’ Guide to Investing cover?

The Bogleheads’ Guide to Investing covers a wide range of topics related to investing and personal finance. These topics include: asset allocation strategies; index fund selection; taxation; retirement planning; estate planning; budgeting; stock market analysis; mutual fund selection; bond selection; diversification strategies; risk management strategies; and more.

###How can The Bogleheads’ Guide to Investing help me make better investing decisions?

The Bogleheads’ Guide to Investing provides readers with a comprehensive overview of the investing process and its associated principles. It explains key concepts such as asset allocation, index funds, taxation, retirement planning and estate planning in an easy-to-understand way. By providing detailed information about different investment vehicles and strategies, it can help readers make informed decisions about their investing goals and objectives. In addition, it offers practical tips for managing risks associated with investing.

Hi, my name is Lloyd and I'm a book enthusiast. I love to read all kinds of books, from classic literature to modern fantasy, as well as non-fiction works. I also enjoy writing reviews and giving my opinion on the books that I have read.