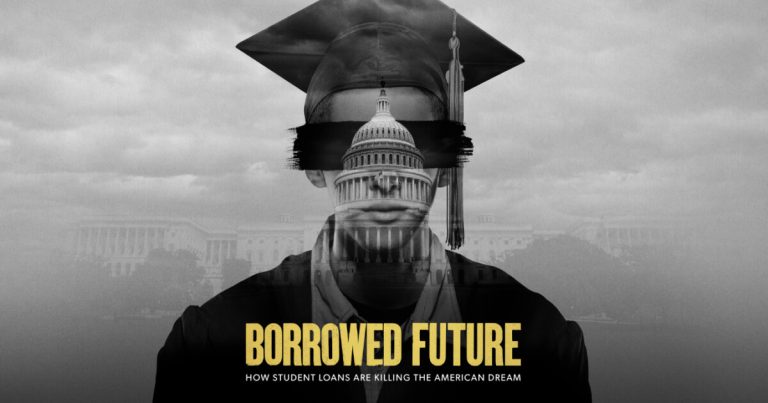

“Borrowed Future” by Dave Ramsey is an inspiring read for anyone looking to get out of debt and start a financially secure future. This book has been praised for its easy-to-understand lessons on financial discipline and planning, making it the perfect choice for those just getting started in learning how to manage their money.

The key features of this book include practical advice on budgeting, saving and spending wisely, as well as strategies on how to pay off debt quickly. Ramsey also provides helpful information on how to build a strong emergency savings fund, and how to set up a retirement plan. Additionally, he provides guidance on how to avoid the pitfalls of borrowing money in order to purchase items that will depreciate over time.

Product details are extensive, covering everything from creating a budget to investing and retirement planning. The book comes with tools to help readers track their progress and understand their options when it comes to debt repayment. There are also resources available online for further reading and assistance.

Pros of this book include its comprehensive coverage of personal finance topics and its easy-to-follow approach. For those just starting out in understanding finances, the book provides an excellent foundation. It is also written in plain language making it accessible to all audiences. Additionally, Dave Ramsey’s reputation as a trusted source in personal finance adds weight to his advice.

Cons of the book include its lack of more advanced financial concepts such as investing or estate planning. It also does not provide specific recommendations on which products or services should be used when implementing Ramsey’s plans.

Overall, Borrowed Future by Dave Ramsey is an excellent guide for anyone wanting to gain a basic understanding of personal finance principles. With its step-by-step approach and clear advice, readers can easily create a plan for achieving financial freedom and security. In the next section we will discuss some tips for implementing the strategies outlined in this book…

Borrowed Future by Dave Ramsey Review

Borrowed Future: Dave Ramsey’s Comprehensive Guide to Financial Planning

Are you feeling overwhelmed by your financial situation? Are you looking for a comprehensive guide to helping you understand how to plan for your future? Then look no further than Borrowed Future, by Dave Ramsey. This book is the perfect resource for anyone looking to improve their overall financial health and create a plan that works for them.

Key Features of Borrowed Future:

1. Step-by-step guidance on creating a budget, reducing debt, and increasing savings

2. Easy-to-follow advice on investing, retirement planning, and insurance

3. Practical tips on improving personal finance habits

4. Real-life stories from individuals who have achieved financial success

5. Valuable insights into gaining financial freedom and peace of mind

Dave Ramsey’s Borrowed Future provides readers with the knowledge they need to make smart decisions about their money. From creating a budget to reducing debt, this book offers helpful advice for navigating through any financial challenges life may throw at you. With actionable steps and real-life stories of people who have achieved financial success, this book is sure to help you achieve the financial freedom and peace of mind you’ve been looking for. So if you’re serious about getting your finances in order, don’t wait any longer – pick up Borrowed Future today!

Product Details

| Product | Borrowed Future by Dave Ramsey |

|---|---|

| Author | Dave Ramsey |

| Format | Hardcover |

| Publisher | Ramsey Press |

| Publication Date | January 2021 |

| Dimensions | 6 x 0.9 x 9 inches |

| Weight | 14.4 ounces

Borrowed Future by Dave Ramsey Pros and Cons1) Pros: 2) Cons: Who are They forFor those looking for a fresh start and a new way to manage their finances, Borrowed Future by Dave Ramsey is the perfect guide. This comprehensive book provides readers with expert advice and an easy-to-follow plan on how to get out of debt, save money, and achieve financial freedom. With his step-by-step instructions and real-life examples, Ramsey shows readers how they can take control of their money and create a brighter future for themselves. From understanding credit scores and budgeting to investing in the stock market and retirement planning, this book covers it all. Readers will also find valuable tips on how to handle unexpected expenses and build an emergency fund. My Experience for Borrowed Future by Dave Ramsey

When I first read Borrowed Future by Dave Ramsey, I was skeptical. All the books about budgeting and money management seemed so boring to me! But Borrowed Future was different. It was not only informative, but it was written in an entertaining way that kept me engaged and motivated throughout. The book starts off by introducing the concept of “borrowing from the future” and how it can be used as a tool for financial success. Dave Ramsey then goes into detail on how to develop a budget, cut back on spending, and save for retirement. He also provides examples of people who have achieved real success by using this method of budgeting. One of my favorite sections of Borrowed Future is when Dave Ramsey talks about his own experience with debt and how he overcame it through smart decisions. This part really resonated with me because I’ve been in a similar situation before. His story was inspiring and gave me hope that I too could get out of debt if I followed the steps outlined in the book. Overall, I would highly recommend Borrowed Future by Dave Ramsey to anyone looking to take control of their finances and make smart decisions with their money. The advice given in this book is invaluable and will help you achieve long-term financial success.

What I don’t LikeProduct Disadvantages List: How to Get Out of Debt with Dave Ramsey’s Borrowed FutureIf you’re looking for a way to get out of debt and get back on track financially, Borrowed Future by Dave Ramsey is the perfect resource. This book provides an easy-to-follow plan that will help you understand debt and how to eliminate it from your life. With this book, you’ll learn how to:

The best thing about Borrowed Future is that it provides actionable steps that anyone can take to become debt-free. Whether you’re struggling with credit card debt, student loans, or other forms of debt, this book will give you the tools and guidance you need to start making progress right away. Questions about Borrowed Future by Dave Ramsey

What is Borrowed Future by Dave Ramsey?Borrowed Future by Dave Ramsey is a financial guidebook that provides practical advice on how to eliminate debt and build wealth. It includes step-by-step instructions for setting up a budget, creating an emergency fund, and investing for the future. Who is Borrowed Future by Dave Ramsey for?Borrowed Future by Dave Ramsey is ideal for anyone who wants to take control of their finances and learn how to make smart money decisions. It’s great for people who are just starting out with their finances, as well as those who want to get back on track after making mistakes. What topics does Borrowed Future by Dave Ramsey cover?Borrowed Future by Dave Ramsey covers a wide range of topics related to personal finance. In particular, it focuses on strategies for eliminating debt and building wealth, such as budgeting, saving, investing, and avoiding scams. Additionally, it provides guidance on how to achieve financial freedom and create a secure future.

Lloyd Kaufman

Hi, my name is Lloyd and I'm a book enthusiast. I love to read all kinds of books, from classic literature to modern fantasy, as well as non-fiction works. I also enjoy writing reviews and giving my opinion on the books that I have read. |