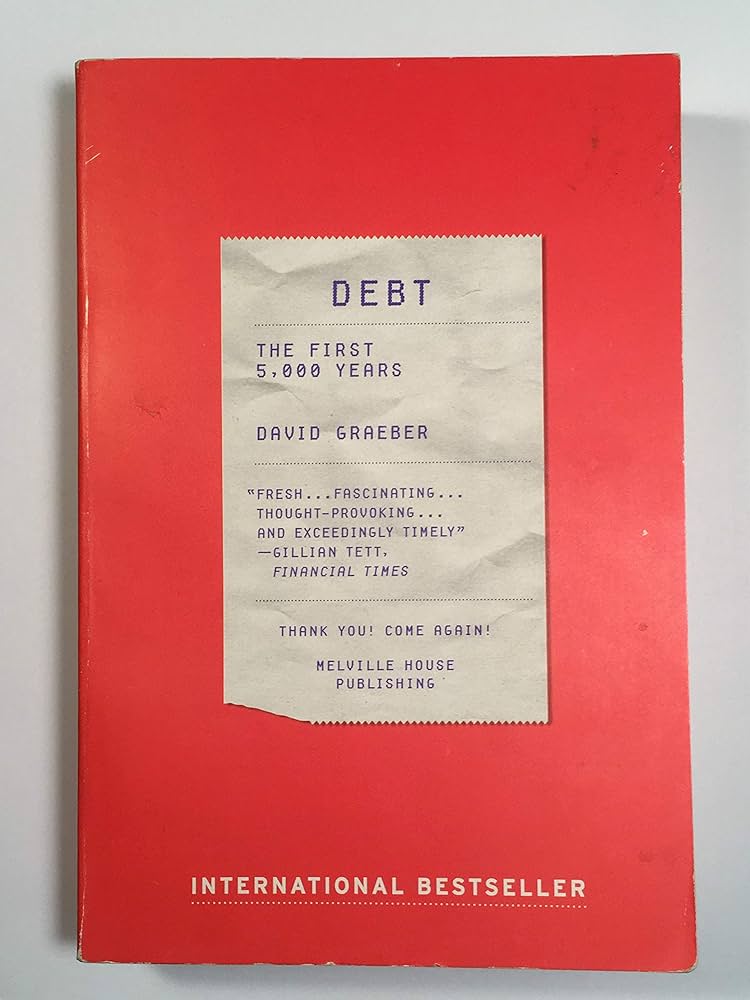

Debt: The First 5,000 Years is an essential read for anyone who wants to understand the history of money and debt. Written by David Graeber, the book offers a comprehensive and fascinating look at the way money has been used throughout human history. It ranges from ancient Mesopotamia to modern-day banking systems, exposing both the positive and negative effects that debt can have on communities. Through its engaging narrative and detailed analysis, Debt: The First 5,000 Years provides a thorough examination of how debt can shape economies, relationships, and social systems.

The book dives deep into the question of why humans have created economic systems based on borrowing and lending in the first place. Graeber looks to our early ancestors for answers, exploring the ways in which prehistoric societies used debt to organize their lives. He then turns his attention to the rise of agrarian empires, tracing the development of complex financial systems that shaped societies for thousands of years. Along the way, he also examines how debt has impacted religion, politics, and warfare.

In addition to its insightful analysis of historical debts and financial systems, Debt: The First 5,000 Years takes an in-depth look at contemporary economic issues. Graeber covers topics such as global inequality, predatory lending practices, and government bailouts with clarity and insight. He also delves into the ethical questions surrounding debt forgiveness and payment plans. Ultimately, this book proves invaluable for anyone looking to gain a better understanding of our current economic climate.

Debt: The First 5,000 Years Review

Debt: The First 5,000 Years is a book by anthropologist David Graeber that has been hailed as one of the most important books of our time. It’s an exploration into the history of money, debt, and credit – from ancient Mesopotamia to today’s global economy. The book examines the ways in which debt has shaped human history, and how we can use this knowledge to change the future.

Key Features:

1. Examines the history of money, debt, and credit from ancient Mesopotamia to today’s global economy

2. Explores how debt has shaped human history and how it can be used for social change

3. Reveals how neoliberal economics have distorted our understanding of debt

4. Analyzes the ways in which debt affects us on a personal level

5. Draws on anthropology, history, philosophy, and economics to create an enlightening look at our economic system

This groundbreaking book takes an interdisciplinary approach to exploring the past and present of money, debt, and credit. It reveals how neoliberal economics have distorted our understanding of debt, as well as its impact on individuals, economies, and societies. David Graeber draws on anthropology, history, philosophy, and economics to provide a comprehensive overview of how debt shapes our world. He also offers insight into how we can use this knowledge for social change. Whether you’re looking for an introduction to the history and current state of debt or want to gain a deeper understanding of it, Debt: The First 5,000 Years is an essential read.

Product Details

| Product | Details |

|---|---|

| Debt: The First 5,000 Years | By David Graeber |

| Published by Melville House Publishing (2012) | |

| ISBN-10: 1612191290 | |

| ISBN-13: 978-1612191291 | |

| Paperback: 608 pages | |

| Dimensions: 5.5 x 0.9 x 8.4 inches |

Debt: The First 5,000 Years Pros and Cons

Debt: The First 5,000 Years is a book by anthropologist and historian David Graeber that provides an overview of the history of debt. The book traces the evolution of debt from its ancient origins to modern times, exploring how debt has shaped our economy, society and politics. Pros

1. Comprehensive Overview: This book offers a comprehensive look at the historical development of debt over thousands of years. It examines how debt has been used as a tool for both good and evil, providing insights into our current economic situation.

2. Insightful Analysis: Graeber provides thoughtful analysis and commentary on the impact of debt on society, highlighting its role in social unrest and inequality.

3. Engaging Writing Style: Graeber’s writing is engaging and easy to follow, making this book accessible to readers with little background knowledge in economics or anthropology.

Cons

1. Limited Focus: While the book does provide an interesting overview of the history of debt, it does not explore other aspects of modern finance such as banking or investment.

2. Complex Concepts: The book may be difficult for readers without a background in economics or anthropology to understand some of the more complex concepts discussed in the text.

3. Lengthy Read: At over 500 pages, this book can be quite lengthy and may not be suitable for casual readers looking for a quick read.

Who are They for

Debt: The First 5,000 Years by David Graeber is a thought-provoking exploration of the history and role of debt in human society. From ancient Mesopotamia to modern times, Graeber shows us how debt has been at the heart of social, political and economic life throughout history. He reveals how debt has shaped our cultural relationships as well as our economic systems and how it continues to influence our lives today.

Graeber’s book offers an insightful look into the development of debt-based economies throughout time and explains why debt is such a powerful force in our lives. He examines the ways that debt has been used to control people, from indentured servitude to wage slavery, and argues for a more equitable system of borrowing and lending. This groundbreaking study provides a comprehensive overview of the complex relationship between debtors and creditors over the past five millennia, offering readers a deep understanding of one of the most important aspects of our economic systems.

Through his expansive research and engaging style, Graeber illuminates the ways that debt has impacted societies across the globe and offers insight into our current financial situation. Debt: The First 5,000 Years is an essential read for anyone interested in exploring the history and implications of debt on our contemporary world.

My Experience for Debt: The First 5,000 Years

Are you feeling overwhelmed by debt? Don’t worry, Debt: The First 5,000 Years has got you covered! This amazing book provides an in-depth look at the history of debt and its role in our lives. From ancient Mesopotamia to modern-day America, this book will help you understand how debt works and how it can be managed.

I recently purchased Debt: The First 5,000 Years, and I’m so glad I did! As someone who is overwhelmed with debt, this book showed me how to take control of my finances and start working towards a better future. With insightful stories and practical advice, this book gives you the tools you need to get out of debt quickly and efficiently.

I was also amazed by how detailed Debt: The First 5,000 Years is. From the historical origins of debt to the current economic landscape, this book covers every aspect of debt in great detail. It’s easy to understand and filled with helpful advice that anyone can use.

If you’re looking for a comprehensive guide on debt management, then Debt: The First 5,000 Years is the perfect choice for you. With its historical insights and practical tips, this book is sure to help you take control of your finances and achieve financial freedom.

What I don’t Like

Product Disadvantages:

1. It is quite lengthy, with some readers finding it too long and complex to read in one go.

2. The writing style can be dense and difficult to understand for some readers.

3. The book does not provide any clear solutions or advice for dealing with debt.

4. There is a lot of historical and economic information, which can be overwhelming for some readers.

5. It focuses mainly on the history of debt, rather than providing practical advice.

How to Live Debt-Free Using ‘Debt: The First 5,000 Years’

Reading Debt: The First 5,000 Years can help you move closer to living a debt-free life. In his book, author David Graeber explains the history of debt and how it has shaped our world today. By understanding this history, you can learn valuable lessons about your own debt and what steps you can take to get out of it.

One important lesson from Graeber’s book is the importance of creating a budget and sticking to it. This involves making sure that your income exceeds your expenses. You should also track your finances regularly to make sure you are staying within budget. When creating your budget, it’s important to prioritize essential expenses like housing costs and groceries over non-essential expenses like eating out or buying luxury items.

Another step towards becoming debt-free is developing an understanding of different types of debt. Secured loans, for example, require collateral such as a house or car while unsecured loans don’t require any collateral. Knowing the difference between these types of loans can help you make more informed decisions when taking out loans in the future.

Finally, understanding the power of compounding interest is key to reducing your overall debt load. Compound interest is when interest accumulates on both the original principal and the accumulated interest from previous periods. To reduce the amount of interest you pay on credit cards and other debts, pay off as much as you can each month.

By following these steps outlined in Debt: The First 5,000 Years, you can create a plan for getting out of debt and living a debt-free life.

Questions about Debt: The First 5,000 Years

What Is Debt: The First 5,000 Years?

Debt: The First 5,000 Years is a groundbreaking book by anthropologist and historian David Graeber that explores the history of debt from the first recorded credit systems to modern consumer loans. It delves into how today’s financial systems have shaped human behavior and shaped our world.

What Does the Book Cover?

Debt: The First 5,000 Years examines the role that debt has played in economic, political, and social life over thousands of years. It looks at the development of borrowing and lending practices, the impact of debt on global empires, and how it has been used as an instrument of power. It also looks at the role that debt forgiveness has played throughout history.

Who Is This Book For?

Debt: The First 5,000 Years is ideal for those interested in anthropology, sociology, economics, and finance. It is also great for anyone looking for a better understanding of how debt shapes our lives and societies.

Hi, my name is Lloyd and I'm a book enthusiast. I love to read all kinds of books, from classic literature to modern fantasy, as well as non-fiction works. I also enjoy writing reviews and giving my opinion on the books that I have read.