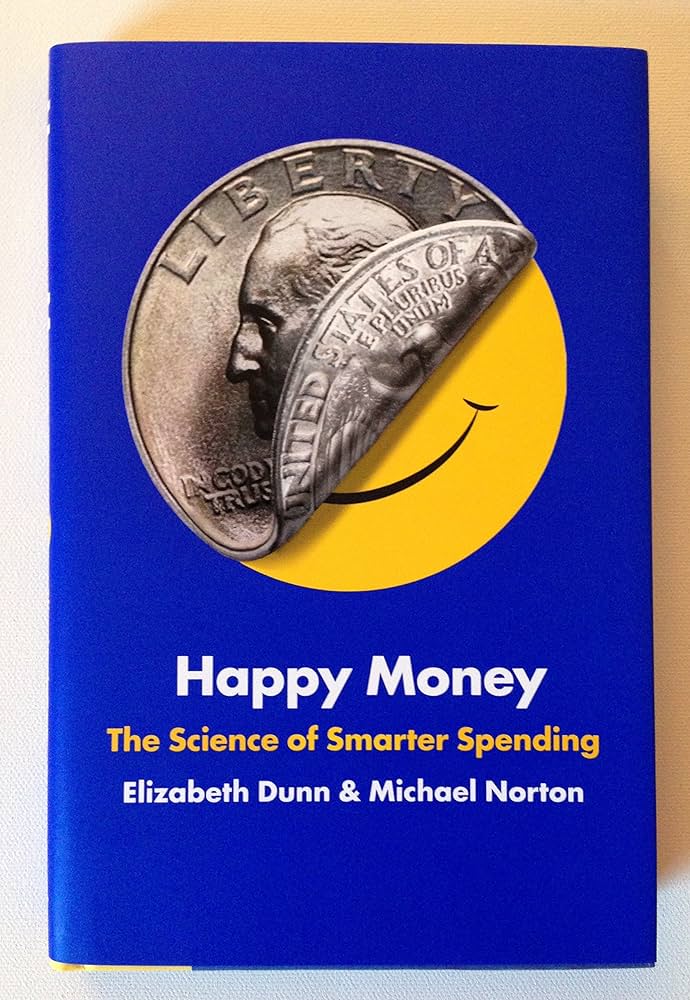

If you’re looking for a way to make your money work harder for you, then Happy Money: The Science of Happier Spending is an excellent choice. Written by renowned behavioral economists Elizabeth Dunn and Michael Norton, this book dives deep into the psychological aspects of spending and how it impacts our overall well-being. With practical advice and engaging stories from real people, this book offers insight into the power of mindful spending. Read on to discover why this book is worth investing in!

Happy Money: The Science of Happier Spending Review

Happy Money: The Science of Happier Spending is a must-read book for anyone looking to save money and increase their happiness. Written by renowned experts in psychology and economics, Elizabeth Dunn and Michael Norton, this book provides the science behind spending money to increase your well-being.

Key Features:

- Explains the five principles of happy money

- Provides practical advice for making smarter financial decisions

- Explores how you can increase your happiness with your spending habits

- Discusses the implications of technology on personal finance decisions

- Reveals new research in behavioral economics and decision-making

The authors use evidence from multiple scientific disciplines to uncover the secrets behind making smart financial decisions. Through their research, they explain the five principles of happy money, which are: Spend less than you earn; Buy experiences not things; Make it a treat; Buy time; and Invest in others. By following these principles, readers will learn how to make better financial decisions that improve their well-being.

In addition to exploring the five principles of happy money, Happy Money also provides practical advice for making smarter financial decisions. Readers will learn how to identify their values when it comes to spending and understand the psychological drivers behind purchasing behavior. They will also discover how technology influences our spending habits and how we can use it to our advantage. Finally, the authors reveal new research in behavioral economics and decision-making to help readers increase their overall happiness with their spending habits.

Product Details

| Product Name | Author | Publisher |

|---|---|---|

| Happy Money: The Science of Happier Spending | Elizabeth Dunn and Michael Norton | Simon & Schuster |

| Publication Details | ||

| First published in 2013 | ||

| 320 pages | ||

| ISBN-10: 1451665075 ISBN-13: 978-1451665079 | ||

| Dimensions: 5.2 x 0.8 x 8 inches | ||

| Weight: 11.2 ounces | ||

| Language: English | ||

Happy Money: The Science of Happier Spending Pros and Cons

1. Pros of Happy Money: The Science of Happier Spending

- It helps to understand how money can make us happier and healthier.

- The book offers practical advice on how to make smarter choices with our money.

- The author provides clear and engaging explanations of the science behind happiness and money.

- It provides a unique perspective on how money affects our emotions and well-being.

2. Cons of Happy Money: The Science of Happier Spending

- Some readers may find the concepts discussed in this book difficult to understand.

- Happy Money does not provide specific advice for people in different financial situations.

- The book is written primarily from an American perspective, so it might not be applicable in other countries.

“Happy Money: The Science of Happier Spending” by Elizabeth Dunn and Michael Norton is a must-read for anyone looking to make smart decisions about their finances. This book dives deep into the psychology behind spending habits and offers valuable insights into how to better manage your money. With clear explanations and practical advice, this book will help you gain control over your finances while also improving your well-being. Whether you are trying to get out of debt or save for retirement, Happy Money can help you make sound financial decisions that will lead to greater happiness and satisfaction.

Who are They forHappy Money: The Science of Happier Spending by Elizabeth Dunn and Michael Norton is a revolutionary guide to making the most of your money. Through cutting-edge research and engaging stories, this book reveals how you can get more happiness from your spending. From buying experiences instead of material things to investing in others’ well-being, this book offers five principles for smarter spending that will help you live better on less.

You’ll learn how to think differently about what you buy and why, as well as discover the surprising science behind using money to increase happiness. Discover strategies for turning everyday purchases into lasting memories, avoiding “buyer’s remorse,” and finding joy in giving. With Happy Money, you’ll be able to use your money in ways that create more satisfaction, connection, and purpose—all while saving time and money.

This book is an invaluable resource for anyone who wants to make smarter financial decisions while still living life to its fullest. Start putting Happy Money into practice today, and experience greater satisfaction with every purchase!

My Experience for Happy Money: The Science of Happier Spending

Have you ever had a moment when your money seemed to be slipping away from you? Why do we spend and how do we make sure that our purchases bring us lasting happiness? I was determined to find out the answers to these questions, so I decided to read Happy Money: The Science of Happier Spending.

The author, Elizabeth Dunn, is an expert in consumer behavior. She has conducted extensive research on how people make spending decisions and what makes them happiest with their purchases. Her insights and findings are truly eye-opening and thought-provoking!

First of all, it’s important to understand that money doesn’t always lead to happiness. Too often, we buy things that give us short-term satisfaction but don’t provide long-term rewards. Dunn argues that instead of just buying whatever catches our eye or whatever is on sale, we should focus on making purchases that will actually make us happier in the long run.

In Happy Money, Dunn explains why certain kinds of spending can have a positive effect on our lives. For example, she suggests that spending money on experiences (like travel) or investing in meaningful relationships (like donating to charity) can bring us more joy than buying material goods. She also encourages us to think about how our purchases will affect our future selves and how they can help us reach our goals.

Finally, Dunn teaches us how to use “happy money” strategies—such as budgeting for pleasure and delaying gratification—to maximize our financial well-being and increase our overall satisfaction with life. By following her advice, I’ve been able to save more money while still enjoying life’s pleasures without guilt!

If you’re looking for ways to get the most out of your hard-earned cash, then Happy Money: The Science of Happier Spending is definitely worth a read! You’ll gain invaluable insight into how you can use your money wisely and ensure that your purchases bring lasting contentment.

What I don’t Like

1. It is difficult to apply the principles in the book: Although the author has made many efforts to explain the principles and ideas of happier spending, it is not easy to put them into practice in real life.

2. The examples provided are limited: The book provides some examples but they are not enough to help people understand how to apply the principles in different situations.

3. The research and evidence presented may be outdated: The research and evidence presented in the book may be outdated since it was published several years ago.

4. Some of the advice is vague: Some of the advice given in the book is quite vague and it can be difficult to understand what the author is trying to say.

5. The book does not provide practical solutions: The book does not provide any practical solutions, which can make it difficult for readers to apply the principles in their own lives.

How to Spend Money for a Happier Life

Do you feel like no matter how much money you have, it’s never enough? Do you want to spend your money in a way that will make you happier and more fulfilled? In Happy Money: The Science of Happier Spending, author Elizabeth Dunn reveals the five keys to spending money in ways that will increase your happiness.

The first key is to “spend money on others”. According to Dunn, one of the best ways to make yourself happier with your money is to use it in service of other people. Whether it’s donating to a charity, buying something special for a friend or family member, or simply taking someone out for lunch, using your hard-earned cash for the benefit of others can provide a significant boost in happiness.

The second key is to “spend money on experiences” instead of material items. Experiences such as vacations, concerts, and even classes can create lasting memories and help us appreciate life more. Studies have shown that these types of purchases tend to bring greater satisfaction than material goods, which can quickly become obsolete.

The third key is to “make it a treat” by occasionally splurging on something special. Though frugality has its merits, occasional indulgences such as a massage or an expensive dinner can be beneficial for our mental health and wellbeing. Just be sure not to overindulge!

The fourth key is to “buy time” by outsourcing tasks that take up too much of your valuable time. Consider hiring a house cleaner, grocery delivery service, or virtual assistant if doing so would free up more time for activities that bring joy into your life.

Finally, the fifth key is to “invest in yourself” by spending on things that will help you reach your long-term goals and dreams. For example, investing in self-improvement classes and personal development tools can pay off in the long run by helping you reach new heights in life.

By following these five tips outlined in Happy Money: The Science of Happier Spending, you can start spending money in ways that will bring true joy and fulfillment into your life!

Questions about Happy Money: The Science of Happier Spending

What is Happy Money?

Happy Money is a book that explores the science of spending money to increase happiness. It looks at research in psychology, economics and neuroscience to provide insights into how money can be used to increase well-being and promote positive life changes.

How does Happy Money work?

Happy Money works by exploring the psychological effects of different types of spending. By examining how our brains process different transactions, it suggests practical strategies for using money to make ourselves happier. For example, it suggests that we should spend money on experiences rather than material things and that we should focus on giving more than receiving.

Who should read Happy Money?

Happy Money is a great read for anyone who wants to gain a better understanding of how their spending habits affect their happiness. Whether you’re looking for ways to improve your financial wellbeing or simply want to learn how to get the most out of your money, this book offers valuable insights on how to use money as an effective tool for achieving greater joy and satisfaction in life.

Hi, my name is Lloyd and I'm a book enthusiast. I love to read all kinds of books, from classic literature to modern fantasy, as well as non-fiction works. I also enjoy writing reviews and giving my opinion on the books that I have read.