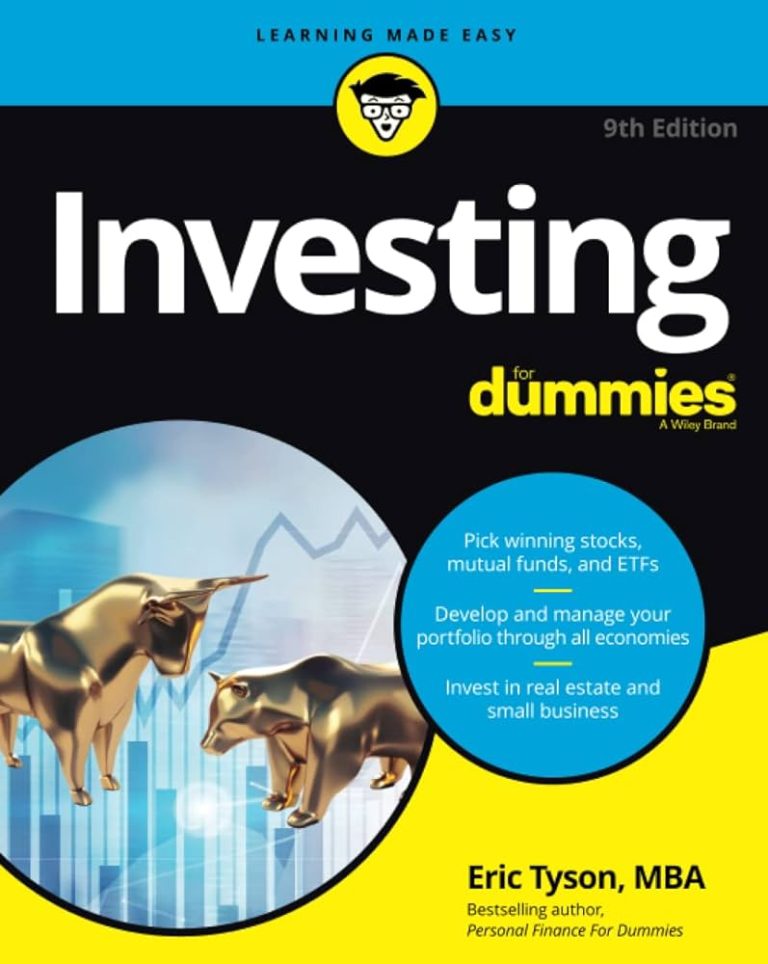

Investing for Dummies is an essential guide if you’re looking to get into investing. Whether you’re an experienced investor or a beginner, this book provides everything you need to know about the world of investing and how to make it work for you. It covers a wide range of topics such as stocks, bonds, mutual funds, real estate, and more. The book is written in easy-to-understand language that makes it accessible to all levels of investors. With Investing for Dummies, you’ll have a comprehensive overview of all the investing options available to you and learn which ones are best suited for your needs.

The book is divided into seven parts, each focusing on a different aspect of investing. Part one covers the basics of investment and introduces key concepts like risk management and diversification. Part two dives deeper into specific investments such as stocks, bonds, ETFs, and mutual funds. Part three looks at alternative investments such as commodities, futures, and options. Part four examines investing in real estate. Part five explores portfolio construction strategies and asset allocation principles. Part six covers retirement planning from 401(k)s to Social Security benefits. Finally, part seven discusses taxes and financial advice for investors.

With Investing for Dummies, readers will gain valuable insight into the world of investing and learn how to create their own individualized portfolio that meets their goals and objectives. In this review, I’ll be taking a closer look at the features that make Investing for Dummies stand out from other books on the subject so that readers can decide whether it’s right for them.

Investing for Dummies Review

Investing for Dummies – the go-to guide for anyone looking to get serious about investing. Investing can be daunting and intimidating, but it doesn’t have to be. With Investing for Dummies, you will learn all you need to know to confidently make smart investments that will help you reach your financial goals.

Key Features:

1. Learn how to start investing in stocks, bonds, mutual funds, real estate, and more

2. Get tips on diversifying your portfolio and managing risk

3. Understand the risks and rewards of different types of investments

4. Discover strategies for retirement planning, long-term investing, and more

5. Updated with new information on tax laws, market trends, and digital advice platforms

Investing for Dummies is an essential guide for anyone interested in taking charge of their financial future. Written in plain English and packed with easy-to-understand examples, this book provides straightforward advice that makes it simple to understand the ins and outs of investing. Whether you are just starting out or an experienced investor looking to expand your knowledge base, Investing for Dummies has something for everyone. From understanding the basics of stocks and bonds to planning for retirement and beyond, this comprehensive guide gives readers a thorough overview of everything they need to know about investing. Plus, with up-to-date information on tax laws, market trends, and digital advice platforms, readers will have access to the most current information available. Take control of your finances today – Investing for Dummies is your one-stop shop!

Product Details

| Product | Investing for Dummies |

|---|---|

| Author | Eric Tyson |

| Publisher | For Dummies |

| Language | English |

| Publication Date | April 1, 2015 |

| Pages | 384 pages |

| ISBN-13: | 978-1119239281 |

Investing for Dummies Pros and Cons

Investing for Dummies: A Comprehensive Guide

Are you looking to get started with investing but don’t know where to begin? Investing for Dummies is the perfect place to start. This comprehensive guide provides a straightforward introduction to the world of investing, giving you all the information you need to make informed decisions about your money. Here are some of the Pros and Cons of Investing for Dummies:

Pros:

1. Easy-to-Understand Explanations: Investing can be a complicated subject, but this book breaks it down into easy-to-understand language that anyone can understand.

2. Step-by-Step Instructions: This book walks you through each step of the investment process and provides helpful advice along the way.

3. Variety of Topics Covered: From stocks and bonds to mutual funds and ETFs, this book covers a range of topics so you can find what’s right for you.

4. Practical Examples: Investing for Dummies features real-world examples so you can see how different strategies could work in practice.

Cons:

1. Limited Detail on Advanced Strategies: While this book is great for beginners, those looking for more advanced information may find it lacking in detail.

2. Outdated Information: The investment landscape changes quickly, so some information in this book may be outdated by the time you read it.

3. No Advice or Recommendations: This book is purely informational and does not provide any advice or recommendations, which can be beneficial if you prefer to make your own decisions.

Overall, Investing for Dummies is a great resource for those looking to get started with investing. With easy-to-understand explanations, step-by-step instructions, and practical examples, it’s an invaluable tool that no investor should be without!

Who are They for

Investing For Dummies is the perfect guide for anyone who wants to get started in investing. Whether you’re a beginner or an experienced investor, this book provides everything you need to know about investing your hard-earned money. From stocks and bonds to mutual funds and ETFs, Investing For Dummies gives you the tools and knowledge you need to make smart investment decisions.

This book gives a comprehensive overview of different types of investments, such as stocks, bonds, mutual funds, real estate, commodities, and cryptocurrency. It also covers basic concepts like portfolio diversification and asset allocation. With easy-to-understand explanations and helpful tips on how to manage risk and navigate the stock market, Investing For Dummies helps readers build a solid foundation for their financial future.

The book also provides practical advice on how to create a personal investment plan that fits your lifestyle and goals. You’ll learn how to choose investments that align with your risk tolerance, set achievable goals for yourself, and track your progress over time. Plus, Investing For Dummies offers all the latest information on Exchange Traded Funds (ETFs) and other new trends in the investment world.

Whether you’re looking to save for retirement or just want to start building wealth, Investing For Dummies is the perfect guide to help you get started!

My Experience for Investing for Dummies

Investing can be a daunting task. When I first started out, I was intimidated by all the financial terms and strategies that go with it. But then I found Investing for Dummies! It’s like having a personal financial advisor in my pocket.

Investing for Dummies takes the guesswork out of investing. With its easy-to-understand language and comprehensive overview of topics, this book has made investing accessible to everyone. From stocks and bonds to mutual funds and exchange-traded funds, Investing for Dummies covers all the basics you need to start investing confidently.

It also gives you tips on how to develop an investment strategy that works best for you. You’ll learn which investments are right for your time horizon, risk tolerance and goals. Plus, you’ll gain insight into common mistakes made by investors so you can avoid them This book is full of helpful advice on everything from creating a budget to understanding taxes.

Whether you’re a beginner or an experienced investor, Investing for Dummies will help you make smarter decisions with your money. Don’t let investing intimidate you any longer – pick up a copy today and get started on your path to financial success!

What I don’t Like

Product Disadvantages

1. Limited scope of topics covered

2. Too much emphasis on stock market investing

3. Lack of focus on alternative investments

4. Some outdated information

5. Poor presentation and organization of content

How to Start Investing with Investing for Dummies

Are you looking to get started investing, but don’t know where to start? Investing for Dummies by Eric Tyson and Tony Martin is a great resource to get you on the right track. This comprehensive guide covers everything from selecting stocks and mutual funds to managing your portfolio and understanding risk.

One of the best features of this book is that it has something for everyone, regardless of your level of knowledge or experience. It includes basic information about stocks and bonds, as well as more advanced topics such as currency trading and hedge funds. The authors also provide advice on how to create a diversified portfolio that works for your individual needs and goals.

The book also provides guidance on managing risk, which is an essential part of any successful investing strategy. They explain different types of risks and how to measure them so you can make informed decisions about your investments.

In addition, Investing for Dummies provides helpful tips on how to choose the right investments for your situation and monitor their performance over time. They also discuss taxes and retirement planning so you can ensure that your investments will help you reach your long-term goals.

Whether you’re just starting out or have been investing for years, Investing for Dummies offers clear explanations and practical advice that can help you become a better investor. With its easy-to-understand concepts and straightforward language, this book is an invaluable resource for anyone looking to make smart investment choices.

Questions about Investing for Dummies

What is investing?

Investing is the act of putting money into a financial asset, such as stocks, bonds, mutual funds or real estate, with the expectation that it will generate income or appreciate in value over time.

How do I start investing?

The best way to start investing is by setting financial goals and evaluating your risk tolerance. Once you have identified your investment objectives, you can start researching investments that match them. Also, look for an experienced financial advisor who can provide guidance and help you make informed decisions.

What are the advantages of investing?

Investing has many potential benefits, including building wealth over time, diversifying your portfolio and creating a stable retirement income. It also offers the potential to grow your capital more quickly than through traditional saving methods.

Hi, my name is Lloyd and I'm a book enthusiast. I love to read all kinds of books, from classic literature to modern fantasy, as well as non-fiction works. I also enjoy writing reviews and giving my opinion on the books that I have read.