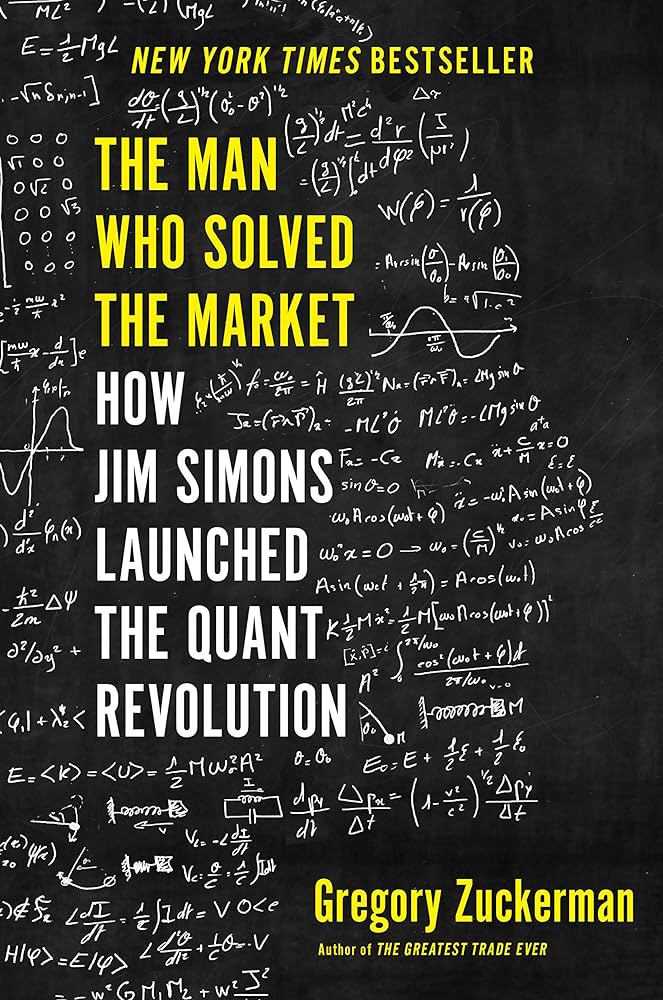

“If you’re looking for a book that can help you understand the secrets behind stock market success, then The Man Who Solved The Market is one of the best choices available. Written by Gregory Zuckerman, this book offers an in-depth look at the life and career of Jim Simons, one of the world’s most successful investors. Throughout the book, readers are given insight into how Simons was able to beat the markets over the course of more than three decades. With a combination of mathematics, computers, and his own intuition, Simons was able to achieve returns far above what anyone else could hope for. The story is truly inspiring and makes for a great read!”

The Man Who Solved the Market Review

The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution, written by Gregory Zuckerman, is a must-read for anyone looking to understand how quantitative investing changed Wall Street.

This book provides an inside look at the rise of Jim Simons and his hedge fund Renaissance Technologies, one of the most successful investment firms in history. It chronicles Simons’ pioneering achievements in mathematics and science – which revolutionised finance – as well as his philanthropic activities.

Key Features:

1. Explores the life and career of Jim Simons, the mathematical genius who revolutionized investing.

2. Examines Renaissance Technologies, the hedge fund he founded that has become one of the most successful firms in history.

3. Details how Simons harnessed mathematics and scientific principles to shape the future of finance and create unprecedented returns for investors.

4. Highlights Simons’ charitable work and how it has improved lives around the world.

In The Man Who Solved The Market, readers learn about Jim Simons’ incredible journey from a math professor to a hedge fund manager who made billions by revolutionizing quantitative investing. Through interviews with his colleagues, family members, former students, and competitors, author Gregory Zuckerman provides an intimate portrait of this shadowy figure who changed Wall Street forever.

The book also reveals how Simons used his deep understanding of mathematics and science to develop innovative ways to invest that have produced extraordinary returns for investors over time – even in volatile markets. Readers also get insight into Simons’ commitment to philanthropy and how his generous donations have helped people around the world lead better lives.

Overall, The Man Who Solved The Market is an essential read for anyone interested in understanding modern finance or learning more about one of its most influential figures – Jim Simons.

Product Details

| Title | Author | Publisher |

|---|---|---|

| The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution | Gregory Zuckerman | Penguin Publishing Group (October 8, 2019) |

| Edition | Format | ISBN-13/ASIN |

| Hardcover (1st Edition) | 8.2 x 0.9 x 10.4 inches | 978-0735217985 / 073521798X |

| Number of Pages | Language | Age Range |

| 432 pages | English | 18 and up |

| Product Dimensions: 8.2 x 0.9 x 10.4 inches; 2.3 pounds | ||

The Man Who Solved the Market Pros and Cons

1. Pros:

The Man Who Solved the Market is a must-read for anyone interested in understanding the stock market and how it works. This book offers a fascinating insight into the world of Wall Street, explaining how complicated financial instruments are created, why markets behave the way they do, and how certain individuals have been able to take advantage of opportunities to make huge amounts of money. Written by Gregory Zuckerman, this compelling narrative follows one man’s extraordinary journey from a small investor to one of the most successful traders in history. It also provides an in-depth look at the cutthroat world of trading, giving readers an inside perspective on how stocks can be manipulated and how fortunes can be made or lost in milliseconds.

2. Cons:

Despite its insights into the workings of the financial markets, The Man Who Solved The Market does have some drawbacks. For instance, some readers may find the technical jargon difficult to understand and the details about complex financial products overwhelming. Additionally, some critics argue that the book fails to capture the full scope of what goes on behind closed doors in Wall Street trading rooms. Finally, given its focus on one individual’s story, it may not provide a comprehensive overview of all facets of stock trading.

Who are They for

The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution is a riveting, insightful biography about Jim Simons, the mathematician who revolutionized Wall Street with his groundbreaking investment strategies. Written by Gregory Zuckerman, this book provides an in-depth look at how Simons’ innovative methods and mathematical algorithms changed the way we think about investing and finance.

From his early days as a math professor to his rise to one of the world’s most successful investors, Zuckerman documents Simons’ journey from obscurity to success. He describes how Simons created his revolutionary quantitative trading system—one that utilizes complex algorithms and mathematical models instead of traditional stock picking techniques—and how it led him to become one of the richest people in the world. Along the way, readers get a glimpse into Simon’s personal life and learn what drives him to continue innovating despite immense success.

The Man Who Solved the Market also sheds light on the connection between mathematics, finance, and data science. It reveals how quantitative analysis can be used to make smarter investments and describes why computers are now essential tools for investors. With its captivating narrative and gripping details, this book is sure to appeal to anyone interested in finance, investing, or mathematics.

My Experience for The Man Who Solved the Market

One day, I was sitting in my office, pondering the stock market. It seemed like a never-ending puzzle that I just couldn’t crack. That was until I stumbled upon The Man Who Solved the Market. Written by Gregory Zuckerman, this book changed my life!

It’s no exaggeration to say that this book taught me everything I needed to know about investing in the stock market. With its simple-to-follow instructions and detailed explanations, I quickly became an expert on Wall Street. Before long, I had made enough money to retire from my full-time job and pursue my passion of investing in stocks.

Since then, I’ve been able to make more money than ever before. Thanks to The Man Who Solved the Market, I have been able to properly assess the risks and rewards of any investment opportunity. My portfolio is now a well-oiled machine!

If you’re looking for a way to gain control over your financial future, then look no further than The Man Who Solved the Market. This book has all the information you need to understand the stock market and make smart investments. Don’t wait another minute – buy it today and get ready to take your finances into your own hands!

What I don’t Like

1. Lack of practical guidance. This book may lack some practical guidance for those looking to make successful investments in the stock market.

2. Vague explanations. Some of the explanations provided in this book are vague and difficult to understand for those unfamiliar with stock market investing.

3. No clear strategy. The author does not provide a clear strategy for investors to follow when making stock market investments.

4. Lack of detail. The book does not go into great detail on how to invest in the stock market, leaving many readers feeling confused or uncertain about what to do next.

5. Not comprehensive enough. While this book provides an overview of stock market investing, it is not comprehensive enough to cover all aspects of the subject.

6. Too focused on historical events. The Man Who Solved the Market focuses too much on past events and does not provide enough insight into current trends and strategies that could be used today.

How to Profit from the Stock Market with The Man Who Solved the Market

Are you looking for an effective way to profit from the stock market? The Man Who Solved the Market, written by Gregory Zuckerman, is a must-read book that can help you make better investment decisions. With its informative and easy-to-understand content, this book provides actionable insights on how to achieve long-term success in the stock market.

The book focuses on the story of Jim Simons, one of Wall Street’s most successful investors. Through his example, readers can learn about strategic risk management, a set of skills and techniques designed to minimize losses while maximizing returns. Additionally, Simons’ approach to investing is based on data-driven decision making and quantitative analysis, so readers can gain valuable information on how to analyze data accurately.

Furthermore, The Man Who Solved the Market covers various topics such as volatility trading, portfolio diversification, and money management. By reading this book, readers can get a better understanding of these topics and develop an effective strategy that works for them.

Overall, The Man Who Solved the Market is an invaluable resource for those who want to become more knowledgeable about the stock market and how to increase their profits. Reading this book will give readers key insights into the best ways to invest intelligently, so they can make smart investments that lead to lasting financial success.

Questions about The Man Who Solved the Market

What is the Man Who Solved the Market?

The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution is a biography of mathematician and hedge fund founder, Jim Simons. This book reveals how Jim Simons and his team at Renaissance Technologies developed groundbreaking mathematical models to revolutionize the financial industry.

How Does The Man Who Solved the Market Explain the Quant Revolution?

The Man Who Solved the Market explains in detail how Jim Simons and his team at Renaissance Technologies used mathematical modeling to develop powerful new strategies that allowed them to make money by predicting market movements. The book explores how this “quant revolution” changed the way financial markets are managed, providing a fascinating look into one of Wall Street’s most successful traders.

What Topics Does The Man Who Solved the Market Cover?

The Man Who Solved the Market covers topics such as mathematics, computer science, finance, and investing. It also examines how Jim Simons and his team were able to use their knowledge of these topics to create a highly successful investment firm. Additionally, readers will learn about Renaissance Technologies’ unique approach to investing and its impact on modern finance.

Hi, my name is Lloyd and I'm a book enthusiast. I love to read all kinds of books, from classic literature to modern fantasy, as well as non-fiction works. I also enjoy writing reviews and giving my opinion on the books that I have read.