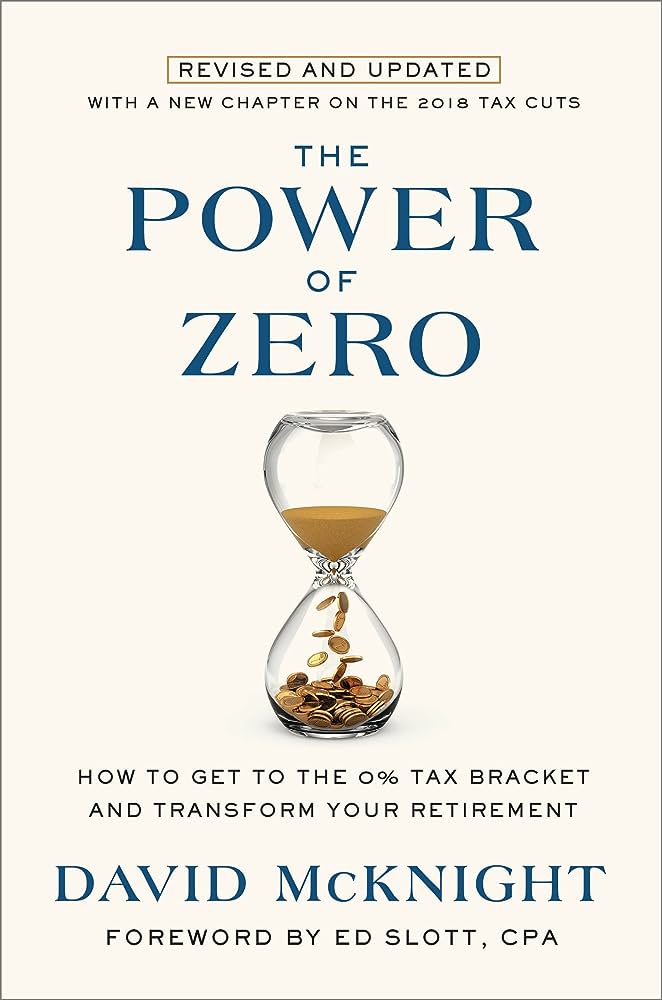

The Power of Zero, Revised and Updated: How to Get to the 0% Tax Bracket and Transform Your Retirement is an essential guide for anyone looking to maximize their retirement income. Written by David McKnight, a best-selling author and financial expert, this book provides readers with a comprehensive understanding of how to get to the 0% tax bracket and create a secure financial future. With step-by-step guidance on navigating the taxation system, this book shows you how to make smart decisions that will help you reach your retirement goals faster. It also offers advice on how to create a plan that works best for your individual circumstances, as well as tips on how to invest in stocks, bonds, mutual funds, and other options. The Power of Zero provides readers with all the information they need to understand their finances and make the most of their retirement savings.

The Power of Zero, Revised and Updated: How to Get to the 0% Tax Bracket and Transform Your Retirement Review

Start Investing in a 0% Tax Bracket and Transform Your Retirement with The Power of Zero

For those of us looking to make the most of our retirement, there is no better way than The Power of Zero: Revised and Updated. This book can help you get to the 0% tax bracket, and transform your retirement in ways you never imagined. With this guide, you’ll be able to start investing, reduce taxes, and much more – all while boosting your retirement savings!

Key Features of The Power Of Zero, Revised and Updated: How to Get to the 0% Tax Bracket and Transform Your Retirement

1. Learn how to take advantage of the 0% tax bracket

2. Understand how tax rates impact your investments

3. Discover strategies for reducing taxes on Social Security income

4. Receive guidance on setting up an IRA or Roth IRA

5. Explore options for converting traditional IRAs into Roth IRAs

6. Get tips for using municipal bonds for tax-free income

7. Find out how annuities can play a role in your retirement planning

8. Uncover how to maximize long-term returns and minimize taxes

The Power of Zero is packed with information that can help you make the most of your retirement savings without paying a hefty amount in taxes. Whether you’re just starting out or already have some investments set aside for retirement, this book can provide valuable insights that will help you reach your financial goals faster. It’s written in plain English so anyone can understand it – even if you don’t consider yourself an expert on taxes or investing. Plus, its step-by-step approach makes it easy to follow along and start applying the strategies discussed right away! So what are you waiting for? Take control of your retirement savings today with The Power of Zero!

Product Details

| Product | The Power of Zero, Revised and Updated: How to Get to the 0% Tax Bracket and Transform Your Retirement |

|---|---|

| Author | David McKnight |

| Publisher | Portfolio |

| Publication Date | February 18, 2020 |

| Language | English |

| ISBN-13 | 9781984823076 |

The Power of Zero, Revised and Updated: How to Get to the 0% Tax Bracket and Transform Your Retirement Pros and Cons

1. The Power of Zero, Revised and Updated: How to Get to the 0% Tax Bracket and Transform Your Retirement

This book is an essential guide for anyone looking to transform their retirement and get to the 0% tax bracket. It’s written by David McKnight, a nationally-recognized financial expert and best-selling author, and his insights are invaluable in helping you understand the ever-changing landscape of taxes, investments, and retirement planning.

Pros:

- Provides comprehensive information on how to reach the 0% tax bracket.

- Explains the complexities of the US tax code in a clear and understandable way.

- Offers practical advice on how to maximize your retirement savings.

Cons:

- May be too detailed for some readers.

- The solutions may not be applicable in every situation.

Overall, The Power of Zero, Revised and Updated: How to Get to the 0% Tax Bracket and Transform Your Retirement, is an invaluable resource for anyone who wants to understand how taxes affect their retirement plans. With its clear explanations and practical advice, it helps readers make sense of a complicated topic and provides strategies for optimizing their finances for maximum savings.

Who are They for

The Power of Zero, Revised and Updated: How to Get to the 0% Tax Bracket and Transform Your Retirement is the go-to book for those looking to maximize their retirement savings and minimize their tax burden. Written by David McKnight, a CPA with over 30 years of experience in retirement planning, this comprehensive guide offers clear, actionable advice on how to get to the 0% tax bracket while still enjoying a comfortable lifestyle in retirement.

McKnight provides invaluable information on investment strategies, tax optimization, retirement income planning, and more so that you can make informed decisions about your retirement finances. He also offers real-world case studies and examples of successful retirement plans that have enabled individuals to reach their financial goals.

This revised and updated edition features the latest developments in tax law and estate planning, as well as advice on maximizing Social Security benefits and other sources of retirement income. With its comprehensive approach, The Power of Zero is an essential resource for anyone looking to secure a financially secure future.

My Experience for The Power of Zero, Revised and Updated: How to Get to the 0% Tax Bracket and Transform Your Retirement

I was always told that I had to save for retirement, but the idea of losing so much of my hard earned money in taxes seemed like a complete waste. That’s when I learned about The Power of Zero, Revised and Updated: How to Get to the 0% Tax Bracket and Transform Your Retirement. It showed me how I could maximize my savings by getting to the 0% tax bracket and transforming my retirement.

The book is full of advice from financial experts on how to reach the 0% tax bracket. It also provides strategies on how to use tax-advantaged accounts like 401(k)s, IRAs, and Roth IRAs to get there. Plus, it explains how investing in the right assets can help you reach your goal even faster.

I was amazed at how easy it was to understand all of the information in The Power of Zero, Revised and Updated. With its step-by-step instructions and helpful visuals, I was able to build an effective plan for reaching my 0% tax rate in no time. And best of all, I’m now confident that I’ll have enough money saved up for a comfortable retirement!

What I don’t Like

Product Disadvantages:

1. The book is somewhat outdated, as changes in tax laws have occurred since its original publication date.

2. It does not provide detailed guidance on how to apply the strategies discussed to individual tax situations.

3. It does not cover some of the more recent developments in tax law such as the Tax Cuts and Jobs Act of 2017.

4. The strategies discussed in the book may be difficult for non-tax professionals to understand without additional guidance from a qualified accountant or financial advisor.

5. It may not be suitable for those who are already retired and do not have enough time to implement the strategies presented in the book.

How to Get to the 0% Tax Bracket with The Power of Zero, Revised and Updated

Are you looking for ways to reduce your taxes and transform your retirement? The Power of Zero, Revised and Updated: How to Get to the 0% Tax Bracket and Transform Your Retirement is your go-to guide. Written by David McKnight, a Certified Financial Planner™ professional, this book provides an in-depth look into how to get to the 0% tax bracket and take advantage of the most powerful tax reduction strategies available.

This book covers a wide range of topics, including strategies on how to protect your assets from taxation, how to create income streams that will last through retirement, and how to make use of the new laws passed in 2019. It also explains why traditional methods of saving for retirement won’t be enough anymore. With clear explanations and helpful examples, readers will learn how to increase their wealth while decreasing their taxes.

The Power of Zero, Revised and Updated provides readers with everything they need to know about taking advantage of the zero percent tax bracket. Readers will learn about different strategies for reducing their taxes, such as utilizing Roth IRA conversions and taking advantage of charitable contributions. Additionally, McKnight outlines best practices when it comes to estate planning, which is essential for retirement planning.

If you want to learn more about how to get to the 0% tax bracket, The Power of Zero, Revised and Updated is an invaluable resource. This comprehensive guide includes all the information needed for those looking for guidance on how to make the most out of the zero percent tax bracket while protecting assets from taxation.

Questions about The Power of Zero, Revised and Updated: How to Get to the 0% Tax Bracket and Transform Your Retirement

What is The Power of Zero?

The Power of Zero: How to Get to the 0% Tax Bracket and Transform Your Retirement is a book by David McKnight that provides strategies for reaching the 0% tax bracket and restructuring retirement plans to maximize their potential. It outlines simple, proven methods for achieving financial freedom through tax-advantaged investments, such as 401(k)s and Roth IRAs.

Who should read The Power of Zero?

The Power of Zero is designed for people who want to reduce their tax burden and secure their financial future. With its step-by-step guide, it is perfect for those who are interested in maximizing their retirement savings while staying within the law.

What topics does The Power of Zero cover?

The Power of Zero covers a range of topics related to retirement planning, including: tax-advantaged investments, income shifting strategies, Social Security optimization, estate planning, and other wealth-building techniques. It also provides helpful advice on how to navigate the often-confusing world of taxes and investments.

How can I use The Power of Zero to maximize my retirement savings?

The Power of Zero provides practical strategies for optimizing your retirement savings. It explains how to take advantage of tax-advantaged investments, shift income between family members to reduce taxes, and make wise estate planning decisions. With these tips in hand, you can develop a plan that will help you achieve financial freedom in retirement.

Hi, my name is Lloyd and I'm a book enthusiast. I love to read all kinds of books, from classic literature to modern fantasy, as well as non-fiction works. I also enjoy writing reviews and giving my opinion on the books that I have read.