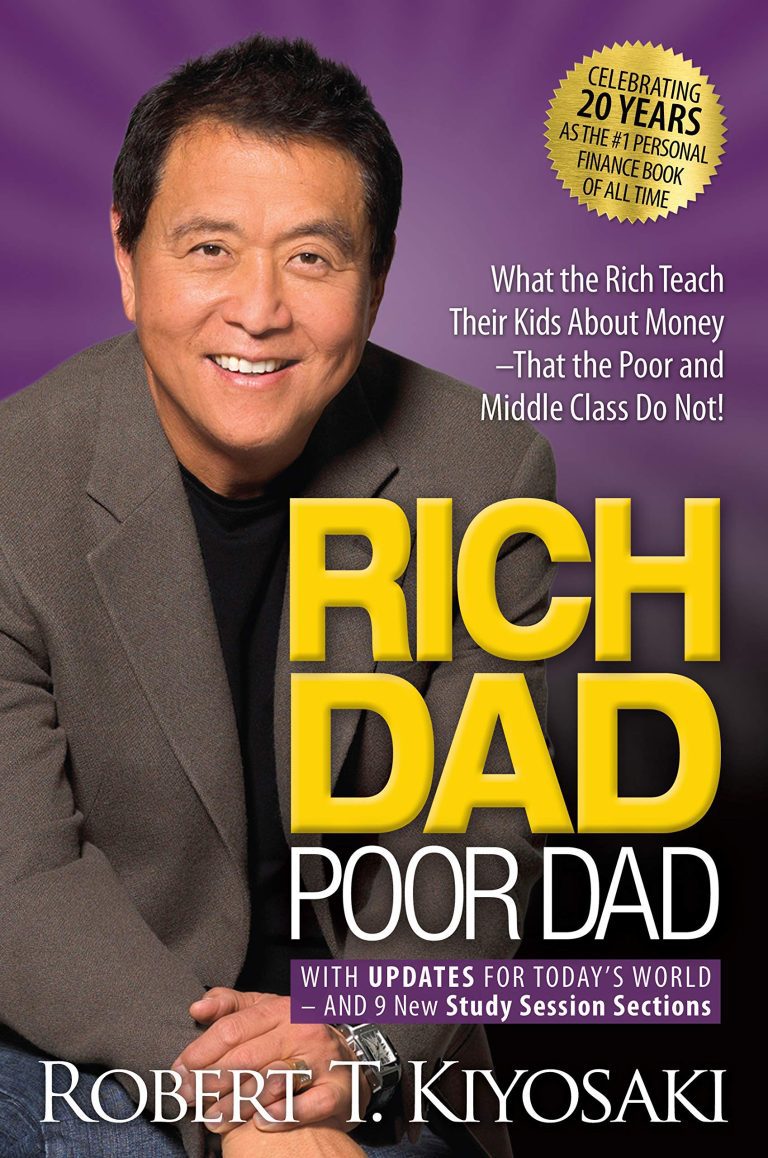

This book, Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! is a must-have for anyone looking to gain financial literacy. Written by Robert Kiyosaki, it has become an international best seller and a classic in the personal finance world. It offers a unique perspective on money and investing that challenges traditional thinking about wealth creation. The key features of this book include its easy-to-understand language and simple storytelling approach that make it accessible to everyone, regardless of their financial background or experience. Additionally, the book is packed with valuable lessons on personal finance, such as how to create passive income streams and build long-term wealth. With its comprehensive coverage of topics like budgeting, taxes, debt management, investing, real estate and more, Rich Dad Poor Dad is an invaluable tool for any aspiring financial guru.

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! Review

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! is a life-changing book for those looking to break through financial barriers. Written by Robert Kiyosaki, this book provides readers with invaluable insights on how to save money, invest wisely, and build wealth in a way that transcends generations. Rich Dad Poor Dad is an eye-opening guide packed with information about personal finance and investing, offering readers the opportunity to take control of their financial future.

Key Features:

1. Uncover why the wealthy have more money than others

2. Discover strategies for creating passive income

3. Learn methods for building long-term wealth

4. Understand how to pay less in taxes

5. Explore techniques for investing in real estate

6. Gain wisdom on how to create multiple streams of income

7. Get advice on how to use debt to your advantage

This powerful book has already changed the lives of millions of people around the world, helping them become financially free and secure their financial future. It’s time you learn from the rich what they know about money and finances! With Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!, you can finally unlock all the secrets of personal finance and start making smart investments that will guarantee lasting success.

Product Details

| Product Details | Description |

|---|---|

| Title | Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! |

| Author | Robert T. Kiyosaki |

| Publisher | Plata Publishing LLC (August 9, 2016) |

| Language | English |

| ISBN-10 | 1612680194 |

| ISBN-13 | 978-1612680191 |

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! Pros and Cons

1. Pros

- Teaches financial literacy: Rich Dad Poor Dad provides readers with an invaluable lesson on the importance of financial literacy and how to manage their money. It helps readers understand the basics of investing, budgeting, and growing their income.

- Easy to read: The book is written in an entertaining, conversational style that makes it easy for readers to understand and apply the advice. It’s full of real-world examples and stories that readers can relate to.

- Inspirational: The book is a great source of inspiration for anyone who wants to get ahead financially. It teaches readers how to think like the wealthy and shows them that anything is possible.

2. Cons

- Not comprehensive enough: While Rich Dad Poor Dad does provide some useful advice, it doesn’t cover everything you need to know about personal finance. Readers may need to supplement this book with other resources in order to gain a more comprehensive understanding of financial planning.

- Too focused on getting rich: The book focuses heavily on achieving wealth, which may not be suitable for everyone. Some readers may find the advice too extreme or even unrealistic.

- Outdated: The book was first published in 1997 and many of its strategies and ideas may no longer be relevant today. Readers should take this into consideration when reading and applying the advice.

This book, “Rich Dad Poor Dad”, has been helping people learn about finances since 1997! Written by Robert Kiyosaki, this book provides invaluable lessons about money management and investing for those who are new to these concepts. No matter if you’re looking for wealth or just want to save up for a rainy day, this book can help you reach your goals. Here are some pros and cons of reading Rich Dad Poor Dad:

- Pros:

- It teaches financial literacy in an entertaining way.

- The information is easy to understand and applicable.

- It inspires readers with its stories of success.

- Cons:

- It’s not comprehensive enough for experienced investors.

- It’s too focused on becoming wealthy quickly.

- Some parts may be outdated due to its age.

If you’re looking for an easy-to-read guide about finances that will motivate as well as educate, look no further than Rich Dad Poor Dad!

Who are They for

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! is a must-read for anyone looking to get ahead financially. Written by Robert Kiyosaki, this timeless book explains the importance of financial literacy and how it can help you build wealth and achieve financial independence. This New York Times bestseller teaches readers how to use money to their advantage, including investing in real estate, building businesses, and creating passive income streams. It also covers topics like debt management and tax planning. With its easy-to-understand lessons, Rich Dad Poor Dad is an essential guide for anyone wanting to make better financial decisions and create wealth for themselves.

In Rich Dad Poor Dad, Robert Kiyosaki outlines his philosophy on money, which is based on taking risks and learning from mistakes. He emphasizes that success doesn’t come without risk; it’s important to take action and be willing to fail in order to reach your goals. He also discusses his theory of financial education, which he believes is essential in developing a successful financial future. Additionally, he provides insights into how to manage debt, invest in stocks and mutual funds, and create multiple sources of income.

Overall, Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! is an invaluable resource for those seeking financial freedom. Whether you’re just getting started or already have some knowledge about personal finance, this book will provide you with the tools you need to become financially secure. With its straightforward explanations and practical advice, this book will help you grow your wealth so that you can live life on your own terms.

My Experience for Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

When I was young, I always wanted to be rich just like my dad. But the problem was that he didn’t teach me anything about money or how to become wealthy. That’s when I stumbled upon Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That The Poor and Middle Class Do Not!

This book changed everything for me. It taught me how to think differently about money and gave me the tools to start my journey towards financial freedom. It taught me that anyone can become wealthy if they are willing to take risks and put in the hard work.

I’m now a successful entrepreneur, and it’s all thanks to this book! I learned how to save and invest my money wisely, create multiple streams of income, and build passive wealth. What once seemed impossible is now very possible because of this book.

If you’re looking for an easy way to learn about money and become wealthy, then Rich Dad Poor Dad is definitely worth checking out! It’s full of useful information that can help anyone achieve financial success. So don’t wait any longer — get your copy today and start building your own financial future!

What I don’t Like

Product Disadvantages:

1. Limited scope of topics covered – the book focuses on investing in real estate and stock markets, but does not cover other forms of wealth building such as entrepreneurship.

2. Over-simplified advice – some of the information presented may be too simplistic for readers with advanced financial knowledge.

3. Lack of detail – the book does not go into great depth about certain aspects of personal finance, such as budgeting or credit management.

4. Unconventional approach – some of the advice given is unconventional and may not appeal to everyone.

5. Potentially outdated information – since the book was written in 1997, some information may no longer be relevant or applicable to current economic conditions.

How to Teach Kids About Money and Finances with Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

Are you a parent looking for ways to teach your kids about money? In Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!, Robert Kiyosaki offers valuable insight on how to instill financial literacy in children and teens. By learning important financial lessons from an early age, your kids can set themselves up for success in their future. Here are some tips from this best-selling book on how to teach kids about money and finances.

1. Make Saving Fun. To get your kids interested in saving money, make it fun by creating incentives for them to save. This could include offering rewards or matching funds when they deposit a certain amount of money into their savings account each month.

2. Use Games to Teach Financial Concepts. Games such as Monopoly or The Stock Market Game are great tools to help your kids understand concepts like budgeting, investing, and banking. These activities can also help teach your kids basic math skills that relate to managing finances.

3. Offer Real-Life Examples. One of the most effective ways to teach your kids about money is to provide them with real-life examples of how you manage finances. Show them how you pay bills, balance your checkbook, invest in stocks or mutual funds, etc. This will help them understand finance vocabulary as well as give them tangible examples of what it means to be financially responsible.

4. Explain Credit Scores. Teaching your kids about credit scores is an important step in helping them understand how credit works and how it affects their financial future. Explain how making timely payments can improve their credit score, while late payments can have a negative impact on their score.

5. Talk About Career Choices. Discuss how different career choices can affect income and lifestyle choices down the road. Help your kids understand that some jobs require more training or education than others and that better salaries often come with greater investments in time and schooling upfront.

By following these steps outlined in Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!, parents can start teaching their kids essential financial lessons early on so they can achieve financial success later in life.

Questions about Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

What is Rich Dad Poor Dad?

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! is a book written by Robert Kiyosaki which focuses on teaching financial literacy to children and adults. The book emphasizes how to turn one’s financial liabilities into assets, how to increase one’s financial intelligence, and how to make money work for you.

Who Should Read This Book?

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! is a great resource for anyone hoping to learn more about personal finance, investing, and wealth creation. Whether you’re just starting out or have been managing your finances for years, this book will provide invaluable tips to help you understand the importance of building long-term wealth.

What Topics Does The Book Cover?

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! covers a range of topics related to personal finance, including: budgeting, saving, investing, real estate investing, taxation strategies, debt management, retirement planning, entrepreneurship, and more. The book also explains how to think like an investor and shares stories from Robert Kiyosaki’s own life experiences.

Is This Book Easy To Understand?

Yes! Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! is written in a clear and concise manner that makes it easy to understand even if you don’t have a background in personal finance. It also features examples from everyday life that make it easier to relate concepts to one’s own situation.

Hi, my name is Lloyd and I'm a book enthusiast. I love to read all kinds of books, from classic literature to modern fantasy, as well as non-fiction works. I also enjoy writing reviews and giving my opinion on the books that I have read.